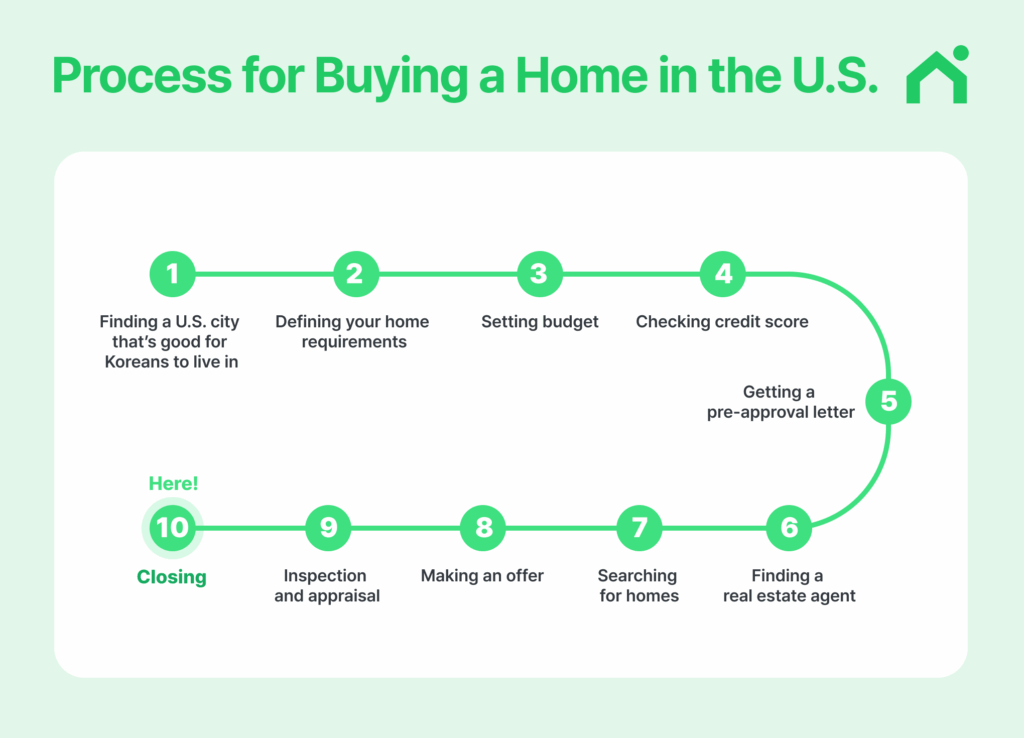

Step-by-Step Process for Buying a Home in the U.S.

The process of buying a home in the U.S. generally goes through 10 steps: 1) Finding a U.S. city that’s good for Koreans to live in, 2) Defining your home requirements, 3) Setting your budget, 4) Checking your credit score, 5) Getting a pre-approval letter, 6) Finding a real estate agent, 7) Searching for homes, 8) Making an offer, 9) Inspection and appraisal, 10) Closing

Even without U.S. citizenship or permanent residency, foreign nationals (including Koreans) can still buy a home and obtain a mortgage in the United States, as long as they meet the required qualifications and prepare the necessary documents.

1. Finding a U.S. City That’s Good for Koreans to Live In

There are many things to consider when buying your first home in the U.S.

When you look at factors like weather, home prices, public safety, school districts, healthcare, community, and growth potential, Georgia can be a very well-balanced choice for first-time buyers.

Georgia offers affordable home prices and cost of living, as well as mild weather and relatively few natural disasters. Key industries such as IT, logistics, film production, healthcare, and education continue to grow there. Major Korean companies including Samsung Electronics, Hyundai Motor, and SK Group have also established manufacturing facilities in Georgia, creating more job opportunities for Koreans. In fact, the hiring rate for Korean engineers has increased by roughly 15%.

Areas in Georgia such as Johns Creek, Duluth, Suwanee, and Alpharetta are promising regions with active Korean communities, well-developed living infrastructure, and strong potential for future home price appreciation. The presence of numerous H Marts, Korean clinics, churches, and restaurants helps foster a tight-knit Korean community.

Especially in Atlanta, which is home to roughly 50,000 Koreans, the city boasts excellent medical facilities, including Emory University Hospital that ranked fifth nationally.

Here’s a brief overview of recommended areas in Georgia:

- Family-focused & top priority on school districts → Johns Creek, Alpharetta

- Korean community & convenience of daily life → Duluth, Suwanee

- Budget-friendly & economic advantages → Duluth, Downtown Atlanta

- Growth potential & shopping → Alpharetta, Downtown Atlanta

→ In the end, you can choose the area that best fits your desired lifestyle.

2. Defining Your Home Requirements

Before buying a home, clearly define your conditions: from the number of rooms to the type of property, and whether you’ll rent or buy. This is the real starting point for home search in the U.S.

Purpose of Home Purchase:

- Family home: Consider space including future children

- Investment property: Focus on potential for price appreciation

- Second home: Prioritize ease of management and location

Location:

- Urban areas: Convenient for commuting and daily life → but home prices are higher

- Suburbs: Good school districts and quiet neighborhoods → suitable for families

- Rural areas: Close to nature → but amenities may be far away

Number of Rooms:

- Bedrooms: Consider family size, working from home, and guest rooms

- Bathrooms: For a family of four, at least two bathrooms are recommended

💡 In the U.S., the number of bedrooms and bathrooms is a major factor used to evaluate a home’s practicality and value (and therefore, its price). Properties with 3 or more bedrooms and 2 or more bathrooms are advantageous for both future resale and rental.

.

Choosing a Property Type

Compared to Korea, property types in the U.S. are much more diverse. When choosing a type of home, think about your budget, maintenance burden, and lifestyle together.

| Type | Characteristics | Best For |

|---|---|---|

| Single-family home | Spacious, fully detached, higher maintenance cost | Families |

| Condo | Shared management, good amenities | Singles / couples |

| Townhome | Multi-level, efficient use of space | Families or mid-range budget |

| Apartment | Mostly rentals, easy management | Short-term residents |

| Duplex / Triplex | Can generate rental income | Investment-focused buyers |

Rent vs. Buying a Home

Renting or buying should be decided based on your financial situation and long-term plans.

| Item | Rent | Buy |

|---|---|---|

| Upfront costs | Low | High (down payment) |

| Mobility | Flexible | More restricted |

| Asset value | No equity | Potential home price appreciation |

📌 Renting is ideal for short-term stays, limited budgets, or uncertain markets.

📌 Buying is ideal for those planning to stay 5+ years or expecting long-term appreciation in property value.

3. Setting Your Budget

When buying your first home in the U.S., it’s important to plan based on your overall budget, not just the “home price.”The most important step before purchasing is to accurately understand your financial status. To do this, check:

- Your annual and monthly income, expenses, assets, credit score, and DTI (Debt-to-Income ratio)

- DTI formula: (Monthly debt payments ÷ Monthly income) × 100

- If your DTI is 43% or lower, your chances of getting loan approval are higher.

Typical Costs (Example: Home Price $500,000)

| Item | Description | Example Amount (for $500,000 home) |

|---|---|---|

| Down payment | Usually 3–20% of home price | $15,000 – $100,000 |

| Closing costs | Loan fees, paperwork, appraisal, etc. | $10,000 – $25,000 |

| Other upfront | Inspection, moving, insurance, taxes, etc. | About $8,800 (first year basis) |

| Emergency funds | For unexpected repairs or living expenses | 3–6 months of mortgage payments |

A stable budget guideline is: 20% down payment + 5% for additional costs + 3–6 months worth of emergency funds.

If the down payment is a burden?

- Through programs such as FHA, VA, and USDA loans, you may start with as little as 0–3.5% down.

- However, if your down payment is less than 20%, you may have to pay PMI (private mortgage insurance).

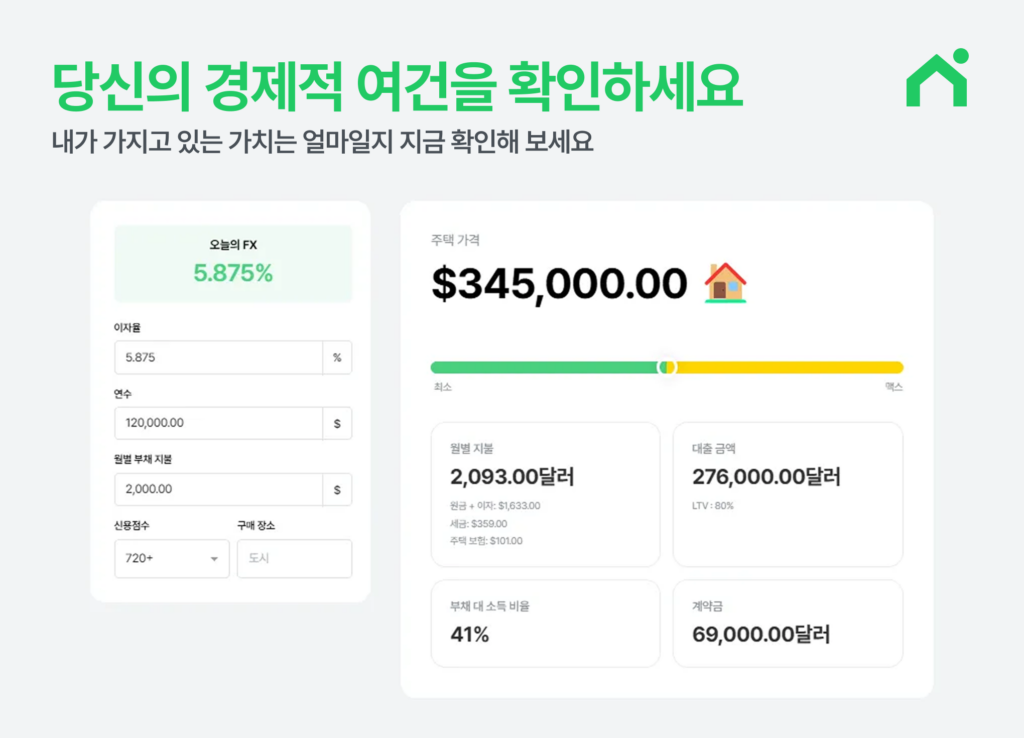

💡 Checking the home price that fits your budget

On Loaning.ai, you can check current interest rates, the home price that fits your budget, and your loan limit in real time with just a few clicks. No personal information required at all!

4. Checking Your Credit Score

Your credit score is critical when getting a mortgage in the U.S. Your score determines whether your loan is approved, what interest rate you receive, and how much you can borrow.

Credit checks are divided into soft inquiries and hard inquiries:

- Soft inquiry: When you check your own score

- Hard inquiry: When a lender checks your score for loan review → can temporarily have a negative effect on your score

When you check your own report, you can also correct inaccurate information.

.

How to Check Your Credit Score

- From the three major credit bureaus – Equifax, Experian, TransUnion – you can receive a free credit report once a year.

- With free credit monitoring services like Credit Karma, Credit Sesame, WalletHub, you can monitor your score in real time. Paid options are also available (around $10–$20 per month according to Experian, 2023).

.

In cases of low or no credit

For Koreans in the U.S. without a tax filing history, it’s likely you don’t yet have a U.S. credit score.

If you have no or low credit, you can look into Non-QM loan products as an alternative.

💡 Loaning.ai mortgage lender helps Koreans (foreign nationals) get home loans even without a U.S. credit score.

Tips for building and improving your credit:

- Start by getting a credit card

- Keep credit utilization under 30% and gradually increase your limit

- Never miss a payment—use auto-pay

- Use rent and utility payment records where possible

- Keep old accounts open

- Minimize unnecessary credit inquiries

.

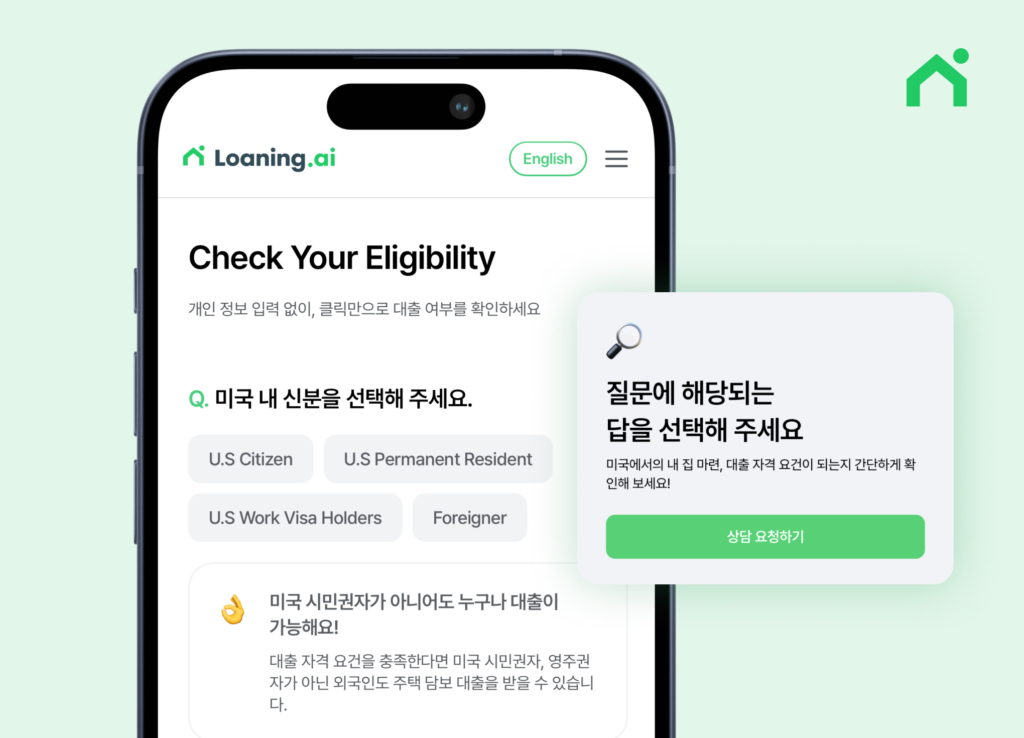

💡 Check your loan eligibility and limits

On Loaning.ai, you can easily check your loan eligibility without complicated paperwork. With just a few clicks and no personal information, you can see whether you’re likely to be approved and what your approximate loan limit is.

5. Getting a Pre-Approval Letter

A pre-approval letter is an official document issued by a bank or lender after reviewing your income, credit score, and debt situation to confirm how much you can borrow.

You can receive it even before choosing a specific home. It gives you a clear idea of your loan limit and serves as the baseline for your home search.

- Check your budget: Analyze monthly income and expenses, confirm your credit score (ideally 620+), and make sure your DTI is 50% or lower.

- Choose a lender:

- Independent mortgage companies handle about 63% of total mortgage originations rather than banks.

- Loaning.ai is an independent mortgage company that offers various loan options and low interest rates so that Koreans can also get mortgage loans.

- Prepare documents: You’ll need tax returns, pay stubs, bank statements, ID, etc. (usually takes 3–5 days).

- Understand rates and limits: Interest rates change daily, and you should always consider TCO (Total Cost of Ownership).

- Check validity period: Usually 60–90 days; you may need to reapply after it expires.

.

Points to consider:

- Compare multiple lenders

- Take discount points and fees into account

- Review your own financial situation

- Minimize the impact on your credit score

- Confirm the pre-approval validity period

.

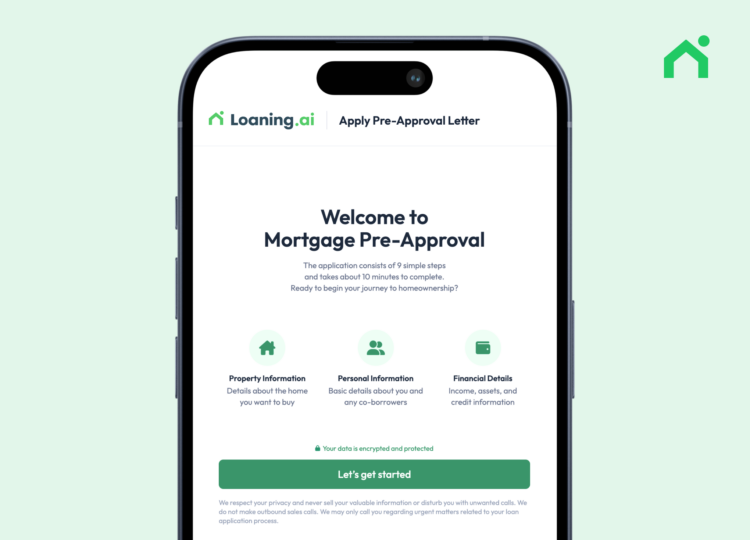

💡 Getting a mobile pre-approval letter

With Loaning.ai, you can get your mortgage pre-approval quickly!

Instead of preparing physical documents one by one, just enter a few pieces of information and receive a mobile pre-approval letter in about 10 minutes.

You can save time on document preparation and get your result much faster.

- To do this, we obtain the necessary credit information from the credit bureaus via the soft check provided by Loaning.ai → this does not affect your credit score.

- Your information is protected through a secure process, so you can use it with confidence.

6. Finding a Real Estate Agent

To buy a home in the U.S., you typically need two key professionals: 1) A realtor (real estate agent), 2) A mortgage lender (broker or loan officer)

1. Realtor

- A professional who finds homes, negotiates, and guides you through the contract from the buyer’s side

- Helps you check MLS listings, attend open houses, and negotiate terms

- Korean realtors are especially helpful because they remove language barriers and know the Korean community well

🔗 Recommended Korean realtor: Visit Han Yoonji Realtor Website

2. Mortgage lender

- A financial expert who compares loan options and connects you with the best product

- There are two other related roles:

- Mortgage broker: Compares various loan products and recommends the best conditions (may charge a fee)

- Loan officer: Works for a specific financial institution and offers products from that institution only

- They analyze your interest rate, loan limit, and approval likelihood and help issue your pre-approval letter.

- Be careful of bad brokers who:

- Put commission first

- Charge unnecessary “junk fees”

- Are slow to process approvals

- Lack transparency

A realtor might recommend a lender, but as a buyer, you’re free to compare and choose your own. If a realtor is a home-search expert, mortgage lender is a funding expert. These two roles collaborate to streamline the homebuying process. Your job as the buyer is to find trustworthy professionals in each role and work with them as a team.

💡 Loaning.ai is an independent mortgage company licensed in California, Georgia, and Texas, providing:

- The most competitive interest rates among the top 5 U.S. lenders

- Fast pre-approvals and closings

- Korean-language consultation and support

7. Searching for Homes

To search for homes in the U.S., you’ll use real estate listing websites like Zillow, Redfin, and Cozying.ai. When choosing a home, you should consider location, school district, Korean community, safety, and your exit strategy.

- Zillow: Offers a wide range of listings plus past sale history and estimated values

- Redfin: Similar to Zillow in features and usability

- Cozying.ai: Focuses on listings in areas preferred by Koreans

1. Zillow / Redfin

- Various listings with past sale history and estimated prices

- Information on school districts and nearby amenities

- Payment calculators to estimate monthly costs

2. Cozying.ai

- Listings centered around Korean-dense areas (California / Georgia / Nevada / Texas)

- Monthly payment calculator

- Access to Korean-speaking agents, ideal for Koreans who are not comfortable with English

- Fast consultation booking and quick access to necessary information

When evaluating homes, consider:

- Location: Transportation, commuting distance to work, commercial districts, and future price growth potential

- School districts: Important for both safety and future value, regardless of whether you currently have children

- Korean community: Availability of Korean markets, clinics, churches, etc.

- Safety: utilize crime rate checker websites (spotcrime.com, neighborhoodscout.com)

- Exit strategy: Choose homes that will be easier to sell later

Additional tips:

- sqft to 평(pyung) calculation: 1 sqft ≈ 0.0281평

- Use open houses: Visit in person to check the condition of the home (usually on weekends). You can go with your realtor.

💡 Check local loan limits

On Loaning.ai, you can enter your desired area and check FHA and conforming loan limits for each region.

For more information, see “How to Search for a Home in the U.S. and Use Real Estate Websites Effectively.”

8. Making an Offer

Submitting an offer on a home in the U.S. isn’t just a way to show interest. It’s a legal document that outlines the price, contract terms (such as closing costs and repair requests), and conditions under which the contract can be canceled (contingencies). In the U.S., you usually submit an offer first, and if the seller accepts it, the contract moves forward.

So, before making an offer, you should:

- Get your realtor’s view on a realistic price

- Think about the value of the property

- Consider how much competition there is

Typical components of an offer:

- Desired purchase price

- Earnest money deposit

- Financing terms (down payment percentage, pre-approval letter attached)

- Preferred closing date

- Items to be included (refrigerator, washer/dryer, etc.)

- Any contingency clauses

Every item you include in the offer can become a negotiation tool and will serve as a legal guideline if disputes arise later.

.

Contingencies: Buyer Protection Clauses

A contingency is a clause that allows you to cancel the contract if certain conditions are not met. These are typically used to reduce risk from the buyer’s side.

Common contingency types:

| Type | Description |

|---|---|

| Inspection contingency | Allows cancellation or renegotiation based on home condition |

| Financing contingency | Allows cancellation if the loan is denied |

| Appraisal contingency | Allows price adjustment or cancellation if the appraised value is lower than the offer |

| Sale-of-home contingency | Allows cancellation if your current home doesn’t sell |

Which contingencies you include can greatly affect the chances of the seller’s offer acceptance. In highly competitive situations, buyers often reduce contingencies as a strategy.

Seller’s response options: Accept, Reject, Counter Offer

Once you submit an offer, the seller usually responds within 24–72 hours:

- Accept: Accepts the offer as is → contract is formed

- Reject: Does not agree with the terms → process ends

- Counter offer: Sends a new proposal with adjusted price or terms

A counteroffer is essentially a “reverse proposal” that the buyer can accept or negotiate again.

This back-and-forth may repeat until both parties reach agreement.

After Contract Formation: Escrow and Deposit Payment

When the seller accepts your offer, a signed purchase agreement is created and an escrow account is opened.

- Earnest money: Typically 1–3% of the home price

- Escrow account: A neutral third party securely holds the deposit and related documents

- Then, according to the contingency schedule, inspections → appraisals → final loan approval proceed in order.

Buyer Strategy: ‘Terms and Timing’ Matter More Than Price

Wanting the home desperately doesn’t mean you should blindly offer the highest price. What sellers really care about is whether you are a buyer who can reliably close To present yourself as a strong buyer.

- Attach a pre-approval letter to your offer

- Offer a larger earnest money deposit

- Be flexible with the closing timeline

- Minimize contingencies when possible

These strategies can help you look like a reliable buyer.

.

Applying for the Loan

If you have already met the loan requirements and received pre-approval, you are mostly done with necessary documents and can feel more at ease. However, if you’ve only completed pre-qualification, you’ll need to submit additional documents.

1. Submit the following to your lender:

- Personal information

- Income information (pay stubs, W-2, 1099, profit & loss statements, etc.)

- Asset information (bank statements, stocks, etc.)

- Credit information (credit score, existing debts)

2. Review Loan Estimate

- All lenders are legally required to send you a Loan Estimate within 3 business days after you sign the purchase contract and submit your application.

- The Loan Estimate lists all estimated costs for purchasing the home, per se closing costs. It includes fees charged by the lender as well as title fees, taxes, appraisal fees, escrow costs, homeowner’s insurance, and other related expenses.

- Although these are estimates and may change slightly, they usually do not change dramatically.

💡 On Loaning.ai, you can easily enter your information and submit required documents online without in-person visits.

9. Inspection and Appraisal

Home inspection and appraisal are essential steps to check the condition and value of the property. Through these processes, you can find out whether there are hidden issues and whether the price is appropriate. You can utilize the home inspection to make your final decision. If you have an inspection contingency, you can request repairs, negotiate the price, or cancel the contract if problems arise. Appraisal is usually carried out within 1–2 weeks after offer acceptance (around the same time as the inspection), and is one of the most important conditions for loan approval.

Home Inspection

- Purpose: Check home condition and structural issues, pest problems, etc.

- Timing: Usually within 7–10 days of offer acceptance

- Cost: $300–$500 (paid by the buyer)

- Items checked: Electrical and plumbing systems, HVAC, roof and foundation, pests (termites), mold, etc.

- Precautions:

- Beware of poor-quality inspectors (check reviews and licenses)

- Because pest and moisture damage is common, a separate pest inspection is recommended

- Consider re-inspection if there is anything suspicious

- Using the results:

- Request repairs

- Renegotiate the price

- Cancel the contract (using the inspection contingency)

Appraisal vs. Inspection

| Item | Home Inspection | Appraisal |

|---|---|---|

| Purpose | Check home condition | Determine market value |

| Hired by | Buyer | Lender |

| Focus | Physical defects, pests, system issues | Market price, neighborhood, property features |

| Cost | $300–$500 | $500–$1,000 |

| Report | Inspection report | Appraisal report |

| Impact | Negotiation of terms and whether to proceed | Loan amount and whether price needs adjustment |

Once you’ve confirmed the home’s condition and value through inspection and appraisal, the next step is finalizing your loan terms.

10. Closing

The main goal of closing is to legally transfer ownership of the home from the seller to you, the buyer. At the same time, your loan terms are finalized and all related costs are settled. In short, closing is the final step that completes the home purchase.

U.S. home closings typically take place 30–45 days after the contract is signed. However, this period may be longer if loan approval is delayed or documents are not prepared on time. That’s why it’s important to move quickly starting from the pre-approval and preparation stages.

Things to Prepare Right Before Closing

- Confirm Loan Terms and Rate Lock

- Finalize the loan terms and interest rate.

- A rate lock is recommended in advance to protect against interest rate fluctuations.

- Obtain Homeowners Insurance

- Must be purchased before closing.

- Premiums may be automatically paid from the escrow account.

- Verify title insurance:

- Each of the seller and buyer may have required insurance (for ownership protection).

- Protects you from issues such as prior liens or unpaid property taxes.

- Final Walkthrough

- Conduct a last inspection of the home just before closing.

- Check for any damages or unfinished repairs that occurred after the contract was signed.

- Review Closing Documents

3 days before closing, you will receive a Closing Disclosure from your lender.- Compare it with your Loan Estimate.

- Confirm that the interest rate, monthly payment, and closing costs are all correct.

If everything looks fine, you can proceed to signing on closing day.

On Closing Day

Closing Day Process

- Meeting with the closing agent

- Meet with the title company, escrow company, or closing attorney.

- Online / remote closing may also be possible.

- Review and sign documents The buyer reviews and signs all documents.

- Mortgage Note: The promise to repay the loan (amount, interest rate, term).

- Deed: Legal document that registers ownership of the home in the buyer’s name.

- Closing Disclosure: Final breakdown of all costs (loan amount, closing costs, insurance premiums, etc.).

- Title Insurance Policy: Document that protects your ownership rights.

- Other documents: Local tax forms, HOA agreements (if applicable).

- Pay closing costs The buyer pays the down payment and closing costs into the escrow account.

- Down payment: The portion of the purchase price paid in cash rather than by financing (usually 5–20% of the price).

- If you already paid an earnest money deposit (EMD), the remaining amount is settled on closing day.

- Closing costs: Usually 2–5% of the home price, including title insurance, lender fees, taxes, etc.

- Cash and personal checks are usually not accepted.

- The lender also wires the loan funds to the escrow account.

- Down payment: The portion of the purchase price paid in cash rather than by financing (usually 5–20% of the price).

- Transfer of ownership and key handover Once all documents and funds have been finalized in the escrow account, the title company proceeds with the ownership transfer.

- Confirms that both the down payment and loan funds have been deposited into escrow.

- Officially records the Deed with the County Recorder’s Office.

- In some cases, the transfer can be completed on the same day as closing.

- Once recording is complete, the home’s legal ownership is officially transferred to the buyer.

- The seller hands over the keys, garage remotes, security codes, etc.

Buy your U.S. home with Loaning.ai

Loaning.ai mortgage lender simplifies the complex loan process and helps you purchase an expensive U.S. home as cost-effectively as possible!

❶ Better rates and terms

Loaning.ai offers most competitive interest rates among the top 5 U.S. lenders, so you can borrow at a lower cost than with many other institutions. Using AI, we provide the most cost-efficient mortgage tailored to your situation!

❷ Fast pre-approval and closing

You can get the pre-approval on your smartphone in about 10 minutes. From pre-approval to actual loan closing, as little as 7 days can be enough.

❸ Check real-time rates yourself

You can check mortgage rates in real time on your own. We provide transparent rates and recommended mortgage options that are most advantageous for you. A dedicated full-time specialist is there to help you check your maximum borrowing amount.

❹ A wide range of loan products available to Koreans

Loaning.ai offers more flexible credit score requirements, options with lower down payments, and higher loan limits than many other lenders. In particular, Koreans without U.S. permanent residency or citizenship can also qualify for loans.

❺ Korean-language support and no unnecessary fees

We provide tailored services for Korean clients. Korean-speaking advisors kindly explain the U.S. mortgage system, and we offer a clean loan process with no junk fees.

For a consultation, click the chat button at the bottom of the Loaning.ai website or contact us via KakaoTalk channel!