If you’re planning to buy a condo, townhouse, or certain types of single-family homes in the United States, one of the most important things you must check is the Homeowners Association Fee (HOA Fee). This is more than just a maintenance fee—it’s a key factor that affects the community environment, property value, and even the future resale potential of your home.

What Is an HOA Fee?

An HOA Fee is a recurring payment that homeowners in a shared residential community must pay. These fees are usually billed monthly and cover the maintenance of common areas, operation of community amenities, various services, and contributions to the reserve fund.

The Reserve Fund is money set aside by the HOA to prepare for major repairs or unforeseen issues that may arise over time. This includes expensive projects such as elevator replacement, roof repair, or exterior reinforcement—work that often costs tens of thousands of dollars.

If the reserve fund is insufficient, homeowners may be charged a Special Assessment, which is why the size of the reserve fund is an important indicator of an HOA’s financial health.

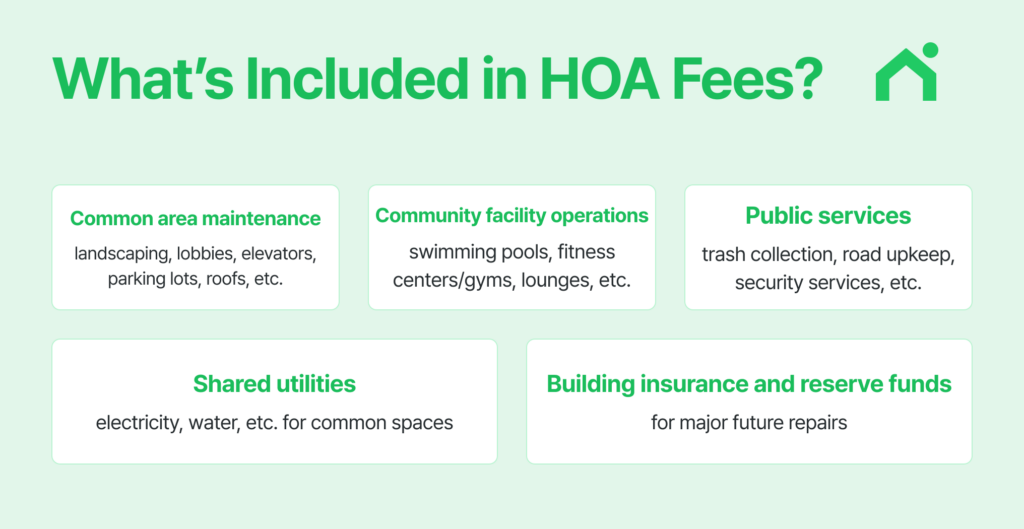

What’s Included in HOA Fees?

- Common area maintenance: landscaping, lobbies, elevators, parking lots, roofs, etc.

- Community facility operations: swimming pools, fitness centers/gyms, lounges, etc.

- Public services: trash collection, road upkeep, security services, etc.

- Shared utilities: electricity, water, etc. for common spaces

- Building insurance and reserve funds for major future repairs

HOA Fees by Region

HOA fees vary widely depending on the region:

- San Francisco, Hawaii, Boston and other high-cost areas: $400–$1,000+ per month

- Texas, Georgia, South Carolina and smaller Southern cities: sometimes under $100

These differences come from local living costs, community size, service level, and natural disaster risks.

How HOA Fees Affect the Housing Market

- Reasonable HOA Fees help maintain community quality and home values.

- Excessively high fees can increase buyer burden, delay transactions, and depress home prices.

- Poor management leads to frequent special assessments and reduces the attractiveness of the property.

- Well-managed HOAs help maintain property values and support long-term appreciation.

Important Things to Watch For

- Missed payments may result in late fees, liens, or even foreclosure.

- Always check for special assessment history.

- HOA fees count toward your Debt-to-Income (DTI) ratio during mortgage qualification, reducing borrowing power.

- HOA fees are not tax-deductible (except in rental property cases, where they can be treated as expenses).

Frequently Asked Questions

Q1. How much are HOA fees?

They range from $100 to over $1,000 per month, with the U.S. average around $125–$300. Condos and townhomes typically have higher fees than single-family homes. Fees are higher in major cities, luxury communities, and coastal areas, and lower in small cities with minimal amenities.

Q2. Do I have to pay HOA fees even if I don’t use the facilities?

Yes. All homeowners are required to pay the HOA fee regardless of facility usage. Fees are shared equally among residents to maintain the community.

Q3. How are HOA fees calculated?

The HOA board prepares an annual budget, and the required operating, maintenance, and reserve costs are divided among members. Fees may vary based on home size, location, or percentage of ownership within the community.

Q4. Can the HOA raise fees at will?

Fee increases or special assessments must follow HOA bylaws (CC&Rs) and state laws. Board approval and prior notice are usually required. Some regions also require homeowner votes.

Q5. Do HOA fees affect my mortgage eligibility?

Yes. HOA fees are included in your DTI calculation, which can reduce the amount you are eligible to borrow.

Q6. Are there additional costs besides HOA fees?

Yes. When purchasing a property, an HOA transfer fee may apply (average $250). Special assessments, fines (for rule violations), and other charges may also occur.

HOA Fee at a Glance

An HOA Fee is one of the essential monthly expenses for homeowners in the U.S. It’s more than a simple maintenance cost, since it plays a major role in determining the overall value of the community and the property.

Checking the reserve fund level is especially critical. If reserves are insufficient, sudden special assessments costing thousands of dollars may be charged.

Therefore, when buying a home, make sure to evaluate not only the location, community structure, and amenities but also the reserve fund, special assessment history, and overall management quality of the HOA.

Planning to Buy a Home in the U.S.?

At Loaning.ai, you can find the latest 2025 guides on U.S. mortgages and the entire homebuying process. Check out Loaning.ai’s homebuying guides to help plan your home purchase.