📝 Offer Accepted: 3-Line Summary

- Loaning.ai provides free Purchase Agreement review for all clients.

- After your real estate contract is signed, you must wire your earnest money deposit (EMD) within 3 business days.

- Prepare the documents needed for the Loan Application and manage your asset sourcing.

Once your offer is accepted, you have a critical 72-hours golden window where certain tasks must be completed without delay.

If you miss something during this period, your hard-won contract could fall apart, and in some cases, you may even lose your deposit. To help you navigate this safely, here is a step-by-step checklist of everything buyers must handle during this phase.

1. Reviewing the Purchase Agreement (Step 1)

Before or immediately after your offer is accepted, take one more careful look at your purchase agreement. A close review can save you thousands of dollars.

Even a small clause in the agreement can eventually lead toover $5,000 in unexpected cost.

A U.S. real estate contract contains numerous clauses directly tied to actual costs.

To ensure no unnecessary fees are imposed, Loaning.ai provides complimentary contract review upon request.

✅ Key Review Points

| Description |

|---|

| ✓ EMD amount & deadline Check whether the EMD amount and due date are reasonable compared to market standards, not overly burdensome. |

| ✓ Inspection / Loan / Appraisal contingency periods Ensure the contingency timelines are realistic for your loan process. |

| ✓ Duplicate or unnecessary fees Look for any redundant or unjustifiable fees charged more than once. |

| ✓ Buyer vs. Seller fees Verify which party is responsible for specific cost items. |

| ✓ Termination clauses Check the conditions under which you can legally cancel the contract if needed. |

If you’re unsure about your agreement, don’t hesitate to request a contract review from Loaning.ai.

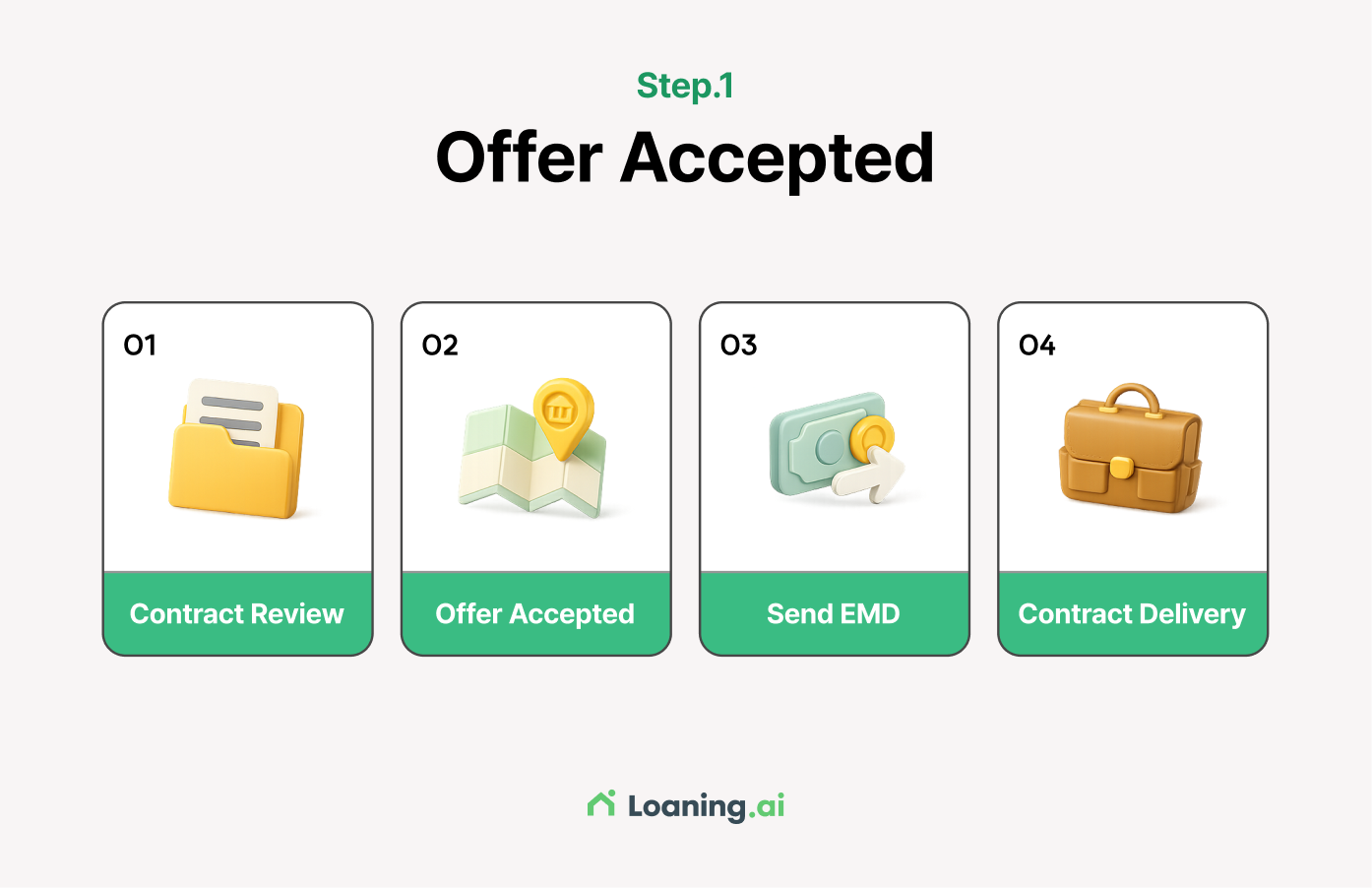

2. What Does “Offer Accepted” Mean?

Offer Accepted means both the seller and the buyer have signed the purchase agreement, agreeing to all terms of the transaction. From this moment, the agreement becomes legally binding, not just a proposal.

✅ What Happens During the Offer Accepted Stage

| Step | Description |

|---|---|

| Contract Review | Confirm inspection periods, contingency terms, EMD amount, etc. |

| Contract Signing | Sign the finalized Purchase Agreement through your Realtor. |

| EMD Deposit | Send your Earnest Money Deposit to the Escrow company. |

| Contract Delivered | The Realtor sends the contract to your lender (Loaning.ai), and the mortgage process officially begins. |

3. Sending Your EMD (Step 2)

The first thing you must do after Offer Accepted is to wire your earnest money deposit (EMD). The amount is typically 1–3% of the home price.

Similar to a “contract deposit” in Korea, EMD shows the buyer’s true intent to purchase the property. It typically falls between 1–3% of the purchase price and should be wired to the Escrow account. A contract is not considered fully effective until this money is deposited.

Because the contract’s legal validity begins only after the EMD is received. Under the California Association of Realtors (CAR) forms, the EMD must be deposited within 3 business days after contract signing.

✅ 4 Safety Rules for Secure EMD Wiring

| Action Item | Description |

|---|---|

| Visit Bank & Request Wire Transfer | ✓ For large transactions, avoid mobile apps. Visit your bank branch and request a wire transfer for maximum security. |

| Security Warning (Wire Fraud) | ✓ Fraudsters frequently impersonate escrow officers to send fake “updated account” emails. ✓ Never trust wire instructions received only via email. |

| Double-Check by Phone | ✓ Before sending, call the escrow officer directly and verbally confirm the account number and beneficiary. |

| Save Wire Receipt | ✓ Save the receipt as a photo or PDF and immediately share it with both your Realtor and your lender/Loaning.ai specialist. |

4. Managing Fund Sourcing (Step 3)

Another crucial responsibility at this stage is preparing your bank statements and ensuring proper fund sourcing.

Under U.S. mortgage underwriting and anti-money laundering (AML) rules, lenders must verify the source of any large deposits that appear in your account.

✅ Fund Sourcing Checklist

| Action Item | Details |

|---|---|

| ✓ Prepare last 2 months of bank statements | • Identify which accounts will be used for down payment, EMD, and closing costs. • If your funds are spread across multiple accounts, plan when and how you will consolidate them. |

| ✓ Check for large deposits | • If there are deposits beyond regular payroll, prepare documentation or explanations. • Avoid unclear cash deposits. |

📝 Quick Checklist

| Checklist | Details |

|---|---|

| Contract Signing & Review | • Before and after Offer Accepted, did you review and understand the key contract terms (price, contingencies, cost allocation) before signing? • If needed, did you request Loaning.ai’s contract review service to ensure there are no unfavorable clauses? |

| EMD Transfer | • Have you planned to wire the EMD to escrow within 3 business days after the contract is executed? • Before sending the wire, did you call the escrow officer directly to confirm the account details? |

| Fund Sourcing | • Have you prepared your bank statements for the past 2 months? • If there are any large deposits, did you prepare supporting documents or a letter of explanation (LOE) to verify the source? |

![Things to Check When Your Closing Disclosure and LE Don’t Match [Mortgage Guider Ep. 6]](https://blog.loaning.ai/en/wp-content/uploads/2026/01/6-350x250.jpg)

![Revised LE & Rate Lock: What to Do and When [Mortgage Guide Ep. 5]](https://blog.loaning.ai/en/wp-content/uploads/2026/01/5-350x250.jpg)

![The Hidden Truth Behind U.S. Mortgage Underwriting: Why Do Approvals Get Delayed? [Mortgage Guide Ep. 4]](https://blog.loaning.ai/en/wp-content/uploads/2026/01/4-350x250.jpg)