Hello, this is Loaning.ai! If you’re looking for a way to reduce your monthly mortgage payment after making a lump-sum payment, mortgage recasting may be the solution. Unlike mortgage refinancing, a mortgage recast adjusts your existing loan balance without applying for a new loan. In this guide, we’ll explain what a mortgage recast is, how it works, its pros and cons, and how it compares to refinancing, so you can decide if it’s right for you.

What Is a Mortgage Recast?

A mortgage recast is a process where you make a large lump-sum payment toward your loan principal, and your lender then recalculates (reamortizes) your monthly mortgage payment based on the reduced balance.

Unlike refinancing, a mortgage recast:

- Does not require a new loan

- Keeps your existing interest rate

- Keeps your original loan term

As a result, your monthly mortgage payment decreases, while the loan structure stays the same.

When Does Mortgage Recasting Make Sense?

You may want to consider a mortgage recast if any of the following apply:

- After Selling a Previous Home

If you purchased a new home before selling your old one, you can use the sale proceeds to pay down your mortgage principal and recast your loan.

- After Receiving a Lump Sum

Bonuses, inheritance, stock gains, or other windfalls can be applied to your mortgage principal to lower your monthly payment.

Mortgage recasting is especially attractive if you already have a low interest rate and want to keep it. However, because it serves a different purpose than refinancing, it’s important to understand the pros and cons of both options and choose what best fits your situation.

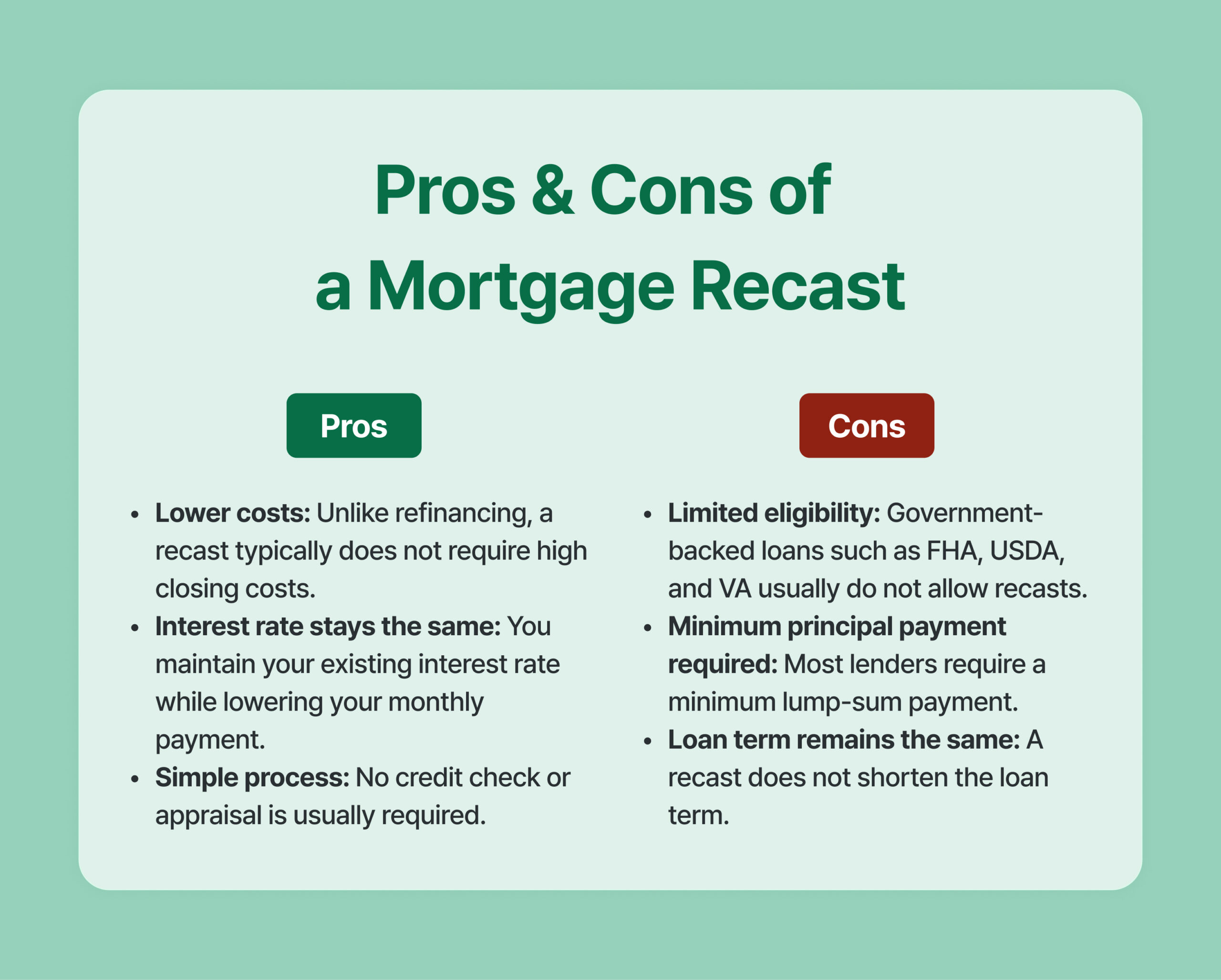

Pros and Cons of Mortgage Recasting

Pros

- Lower costs: Unlike refinancing, recasting does not involve high closing costs.

- Interest rate stays the same: You keep your existing rate while benefiting from a lower principal.

- Simple process: No credit check or home appraisal is required.

Cons

- Limited eligibility: Government-backed loans such as FHA, USDA, and VA loans are not eligible for recasting.

- Minimum principal payment required: Most lenders require a lump-sum payment of at least $10,000.

- Loan term remains the same: Recasting does not shorten your loan term.

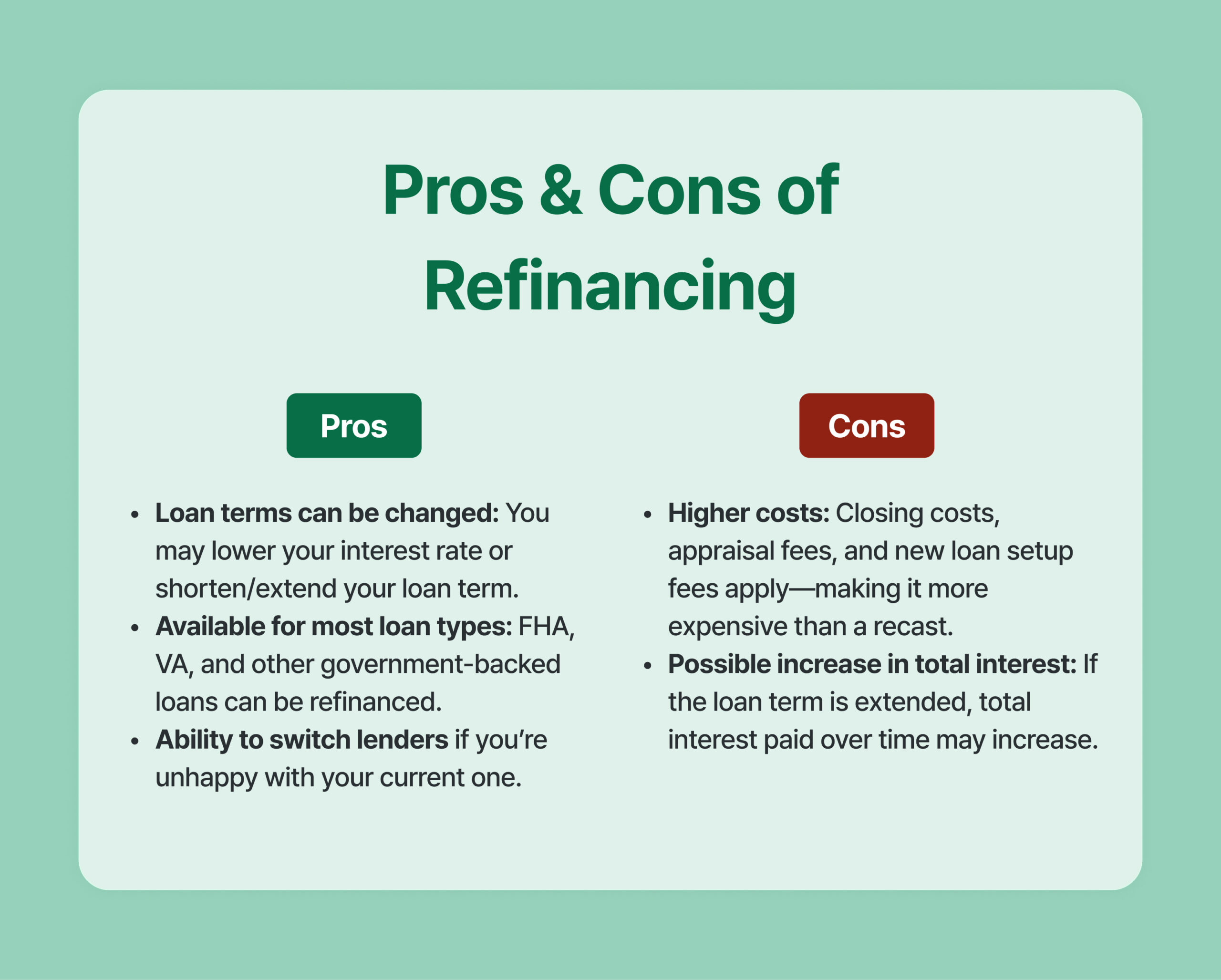

Pros and Cons of Mortgage Refinancing

Pros

- Loan terms can be changed: may lower the interest rate or adjust the loan term (duration).

- Available for all loan types, including FHA and VA loans.

- Ability to switch lenders if you’re unhappy with your current one.

Cons

- Higher costs: Refinancing involves closing costs, appraisal fees, and new loan setup fees, making it significantly more expensive than recasting.

- Potential increase in total interest: A new loan may increase interest costs, especially if the loan term is extended.

Recast vs. Refinance

| Category | Recast | Refinance |

|---|---|---|

| Interest rate | Remains the same | New interest rate applied |

| Loan terms | Cannot be changed | Can be adjusted (term, rate, etc.) |

| Cost | Small fee (typically $250–$500) | Closing costs, appraisal fees, and other expenses |

| Loan type eligibility | Some loans (FHA, VA, etc.) not eligible | Most loan types eligible |

| Change lender | Not allowed | Allowed |

| Principal payment | Lump-sum payment lowers monthly payment | Loan can be restructured |

Is Mortgage Recasting Always the Right Choice?

A mortgage recast can be a cost-effective option if you want to lower your monthly payment using a lump-sum payment. However, if you need to change your loan terms or access additional funds, refinancing may be a better fit.

For personalized advice and side-by-side comparisons, reach out to Loaning.ai. We’ll help you choose the mortgage strategy that best fits your financial goals.

![Things to Check When Your Closing Disclosure and LE Don’t Match [Mortgage Guider Ep. 6]](https://blog.loaning.ai/en/wp-content/uploads/2026/01/6-350x250.jpg)

![Revised LE & Rate Lock: What to Do and When [Mortgage Guide Ep. 5]](https://blog.loaning.ai/en/wp-content/uploads/2026/01/5-350x250.jpg)

![The Hidden Truth Behind U.S. Mortgage Underwriting: Why Do Approvals Get Delayed? [Mortgage Guide Ep. 4]](https://blog.loaning.ai/en/wp-content/uploads/2026/01/4-350x250.jpg)