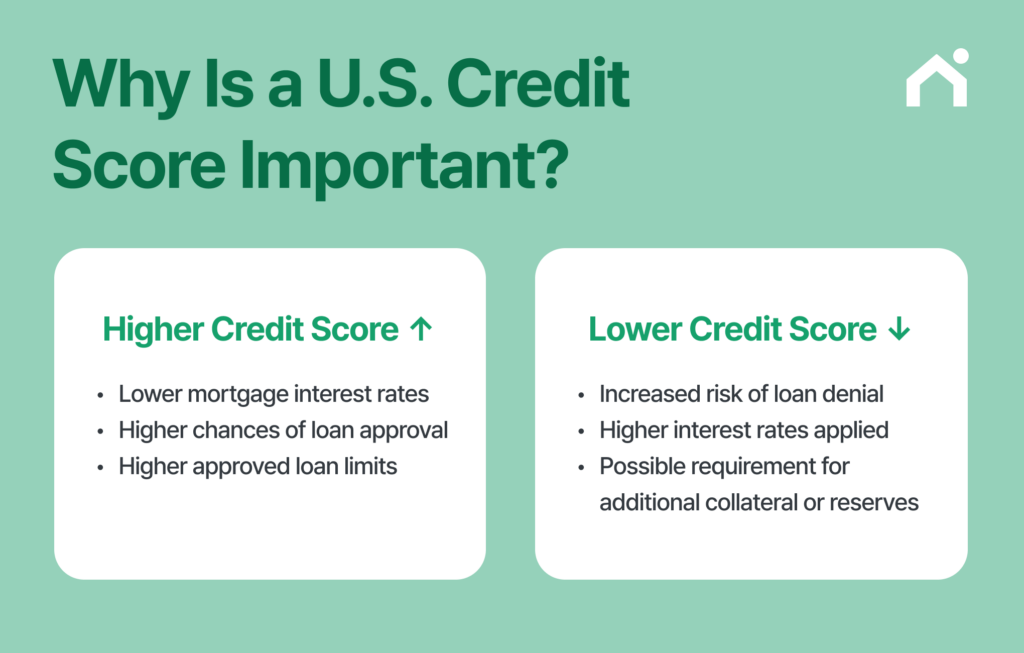

Building a strong credit score is one of the most important steps for anyone planning to finance a home. Your credit score directly determines your loan interest rate, and the difference can easily add up to thousands—or even tens of thousands—of dollars.

To build your credit quickly, start with a beginner-friendly credit card, keep your credit utilization below 30%, raise your credit limit over time, set up autopay to avoid late payments, report your rent and utility payments, maintain older accounts, and avoid unnecessary credit inquiries.

Check your credit score and see your personalized mortgage rates at Loaning.ai!

Why Is Building a Credit Score So Important?

The U.S. is often called a “credit-based society,” where an individual’s credit profile affects nearly every aspect of daily life. Unlike Korea, where credit grades center on banking and loan history, the U.S. evaluates many different factors. Your credit score impacts:

- Mortgage approval and interest rates

- Auto loans

- Apartment rentals

- Cell phone contracts

- Credit card approvals

For mortgage loans in particular, your credit score is the single most important factor determining your interest rate.

Even if two people buy the exact same home, the difference in credit score can create thousands to tens of thousands of dollars in extra interest.

How U.S. Credit Scores Work (vs. Korea)

In Korea, credit is evaluated mainly through your banking activity and loan repayment history. Meanwhile in the U.S., credit scores are determined by the following factors:

| Factor | Weight | Explanation |

|---|---|---|

| Payment History | 35% | Whether you pay bills on time |

| Credit Utilization | 30% | Share of credit limit you are using |

| Length of Credit History | 15% | How long accounts have been open |

| New Credit | 10% | Recent inquiries and new accounts |

| Credit Mix | 10% | Variety of credit types (cards, mortgage, auto loan, etc.) |

Most newcomers from Korea arrive with no U.S. credit history at all, meaning no score. That’s why it’s essential to start building credit before applying for a mortgage.

Your Credit Score Changes Your Mortgage Terms

The higher your credit score, the better your mortgage rate, and the more money you save over time.

| Credit Score | Loan Approval Likelihood | Estimated Mortgage Rate |

|---|---|---|

| 800+ | Very high | Best rates (e.g., 6.0%) |

| 740–799 | High | Low rates (e.g., 6.5%) |

| 670–739 | Average | Standard rates (e.g., 7.0%) |

| 580–669 | Low | Higher rates (e.g., 8.5%) |

| Below 580 | Very low | Difficult approval or extra conditions |

Example: How credit score changes your monthly mortgage cost

A (Credit 780): 30-year fixed mortgage at 6.2% → $2,470/month

B (Credit 650): 30-year fixed mortgage at 8.5% → $2,980/month

→ Same house, $500+ difference every month

→ Over 30 years: $180,000+ more paid in interest

Loaning.ai compares mortgage rates from top 5 U.S. lenders to secure the best possible rate. Check today’s lowest 30-year fixed rates!

Increase Your U.S. Credit Score

How to Build U.S. Credit Score Quickly

1. Start with a Beginner-Friendly Credit Card

If you’re new to the U.S., you likely have no credit score. Start with:

- Secured Credit Card (deposit-backed card)

- Example: Deposit $200 → $200 credit limit

- Credit Builder Card

- Example: Deposit $500 → Make small monthly payments to build history

How to use:

- Spend just $50–$100 per month

- Always pay in full and on time

Impact:

- Score established within 3–6 months

- 650–700 within 1 year with proper management

2. Keep Credit Utilization Under 30% (and Increase Your Limit)

Credit utilization (30% of your score) is one of the fastest ways to increase your score.

How to use:

- If your credit limit is $1,000 → keep spending under $300

- Want to boost your score? Increase your limit (Example: Limit $1,000 → $2,000 with same $300 spending → Utilization drops from 30% to 15% → Score increases)

Expected progress: +20 to +50 points possible

3. Set Up Autopay to Avoid Late Payments

Just one late payment (30+ days) can drop your score by 50–100 points.

Prevent this by:

- Setting autopay for credit cards

- Setting autopay for utilities (phone bill, electricity, Wi-Fi, etc.)

Impact: +5–10 points per month of on-time history

4. Report Rent & Utility Payments

You can boost your score by reporting rent payments using Experian Boost.

How to use: Add rent, utility, and phone bill payments to your credit profile

Impact: +10 to +30 points on average

5. Keep Old Accounts Open

Your credit age (15% of score) improves over time.

How to use:

- Keep your oldest card open, even if you don’t use it

- Add new accounts slowly to diversify your credit mix

Impact: +20 points over time

6. Avoid Excessive Hard Inquiries

Hard inquiries temporarily lower your score. Each inquiry may reduce your score by 5–10 points

Prevent this by: Keeping inquiries under two per year

Impact: Score maintained

How to Check Your Credit Score

There are two types of credit checks:

- Soft Inquiry → Checking your own score (no impact)

- Hard Inquiry → Lenders checking your score for loans (temporary impact)

Still, it’s important to monitor your score regularly to catch errors in your credit report, incorrect late-payment records, or signs of identity theft such as unauthorized accounts.

Where to check for free:

- Annual free reports from Equifax, Experian, TransUnion

- Ongoing monitoring with Credit Karma, Credit Sesame, WalletHub

By monitoring your report, you can get better mortgage terms and prevent issues before they affect your home purchase.

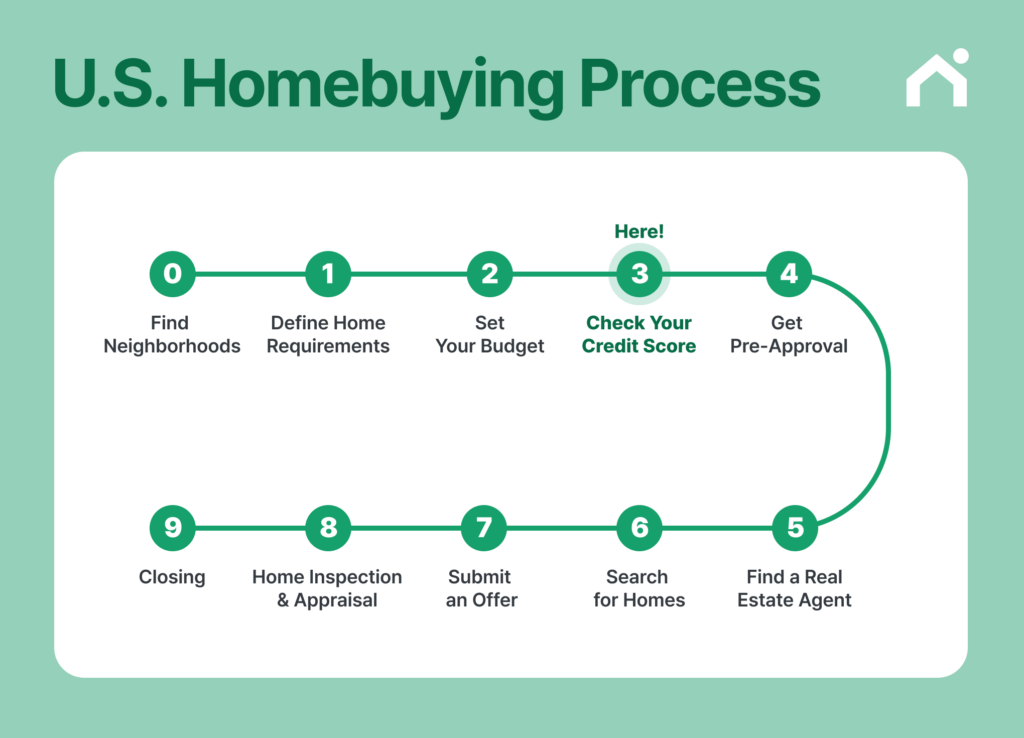

Start Your Homebuying Process with Loaning.ai

A strong credit score means better mortgage rates. After reviewing your credit history, check your personalized mortgage rates with Loaning.ai. It only takes a few minutes — no complicated documents needed.

Improving your credit score helps you lower your mortgage rate, so make full use of the strategies in this guide.

And check today’s lowest 30-year fixed mortgage rates with Loaning.ai to save even more!