Before buying a home, it’s crucial to clearly understand how much mortgage you can qualify for based on your monthly income. In particular, knowing the differences between FHA Loans and Conforming Loans can help you make a smarter decision.

In this article, we’ll compare FHA Loans and Conforming Loans and guide you toward the option that best fits your situation. 🏠

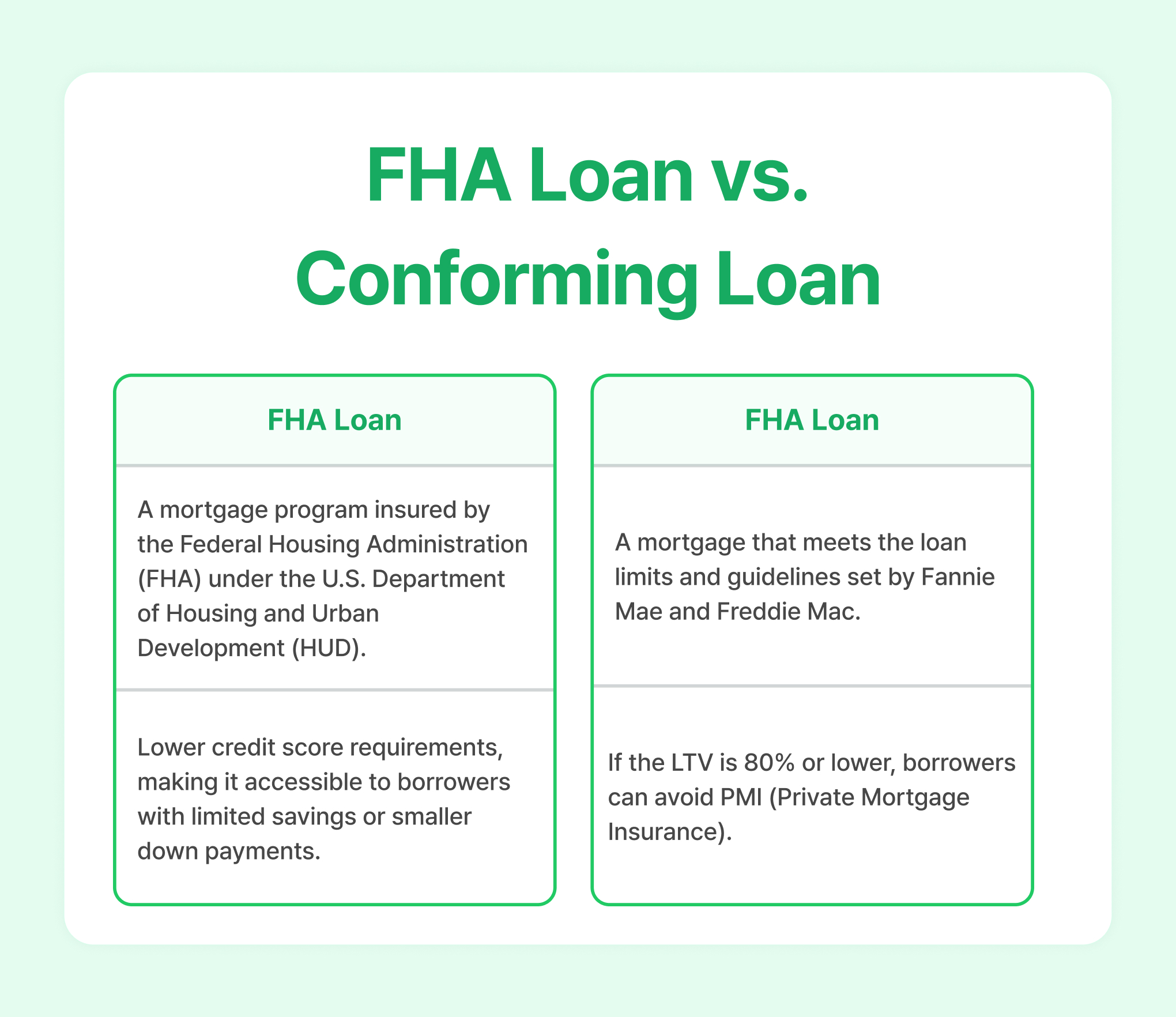

FHA Loan vs. Conforming Loan

Mortgage Loans by Monthly Income

Conforming Loan

For Conforming Loans, the loan amount is generally determined by your Debt-to-Income Ratio (DTI) and Loan-to-Value (LTV) ratio.

- DTI up to 50%: Up to half of your monthly income can be used toward loan repayment.

- LTV up to 80%: You can borrow up to 80% of the home’s value.

While FHA Loans use a similar calculation method, there are several key differences compared to Conforming Loans.

Key Differences Between FHA Loans and Conforming Loans

* PMI (Private Mortgage Insurance): Insurance required for Conforming Loans when LTV exceeds 80%

Understanding FHA MIP (Mortgage Insurance Premium)

MIP varies based on the loan amount and LTV ratio, and both the amount and duration can differ significantly.

- For loan amounts of $726,200 or less:

- LTV ≤ 90%: 0.5% of the loan amount for 11 years

- LTV > 90% to ≤ 95%: 0.5% for the entire loan term

- LTV > 95%: 0.55% for the entire loan term

Loan Amounts by Monthly Income

Loan eligibility and home prices vary depending on the loan type. The tables below are based on standard assumptions for each loan program.

Conforming Loan

Based on a 20% down payment, 80% LTV, and 50% DTI.

| Monthly Income | 20% Down Payment | Loan Amount | Home Price |

|---|---|---|---|

| $5,000 | $71,780.00 | $287,120.00 | $358,900.00 |

| $10,000 | $153,350.00 | $613,400.00 | $766,750.00 |

| $15,000 | $234,920.00 | $939,680.00 | $1,174,600.00 |

| $20,000 | $316,488.00 | $1,265,952.00 | $1,582,440.00 |

| $25,000 | $398,040.00 | $1,592,160.00 | $1,990,200.00 |

| $30,000 | $479,620.00 | $1,918,480.00 | $2,398,100.00 |

FHA Loan

Based on a 5% down payment, 95% LTV, and 56% DTI.

| Monthly Income | Downpayment 5% | Loan Amount | Home Price |

|---|---|---|---|

| $5,000 | $16,615.00 | $315,685.00 | $332,300.00 |

| $10,000 | $35,225.00 | $669,275.00 | $704,500.00 |

| $15,000 | $52,735.00 | $1,001,965.00 | $1,054,700.00 |

| $20,000 | $70,960.00 | $1,348,240.00 | $1,419,200.00 |

| $25,000 | $89,190.00 | $1,694,610.00 | $1,783,800.00 |

| $30,000 | $107,420.00 | $2,040,980.00 | $2,148,400.00 |

Which Loan Should You Choose?

Choosing the right loan depends on your monthly income and down payment capacity:

- Conforming Loan: Ideal if you can make a 20% down payment, allowing you to avoid PMI and reduce long-term costs.

- FHA Loan: A strong option if you have limited upfront funds or need a higher LTV, though MIP applies.

- With the same monthly income, FHA Loans typically offer higher borrowing power due to more flexible back-end DTI limits.

- FHA Loans often have slightly lower interest rates, which can increase total loan eligibility.

- One major advantage of FHA Loans is that even with a $5,000 monthly income, borrowing over $300,000 may be possible.

Conforming Loans Are Best If You:

- Have a high credit score and want to avoid PMI

- Prefer loans with no upfront insurance costs

FHA Loans Are Best If You:

- Have limited savings or a lower credit score

- Need more flexible qualification standards

At Loaning.ai, we compare FHA and Conforming Loans in detail and recommend the mortgage option that best fits your financial situation.

Loaning.ai provides personalized mortgage plans tailored to your financial profile and helps guide you every step of the way toward your dream home.

Start your next chapter with Loaning.ai. 😊

![Things to Check When Your Closing Disclosure and LE Don’t Match [Mortgage Guider Ep. 6]](https://blog.loaning.ai/en/wp-content/uploads/2026/01/6-350x250.jpg)

![Revised LE & Rate Lock: What to Do and When [Mortgage Guide Ep. 5]](https://blog.loaning.ai/en/wp-content/uploads/2026/01/5-350x250.jpg)

![The Hidden Truth Behind U.S. Mortgage Underwriting: Why Do Approvals Get Delayed? [Mortgage Guide Ep. 4]](https://blog.loaning.ai/en/wp-content/uploads/2026/01/4-350x250.jpg)

![How to Escape Third-Party Pitfalls: When the Appraisal Comes in Lower Than the Purchase Price [Mortgage Guide Ep. 3]](https://blog.loaning.ai/en/wp-content/uploads/2026/01/3-350x250.jpg)