Would you sign a contract after seeing a 5.5% 30-year fixed mortgage rate, only to later realize you’re paying $11,000 more than other buyers? 😶🌫️

Many homebuyers fixate on the “lowest rate” headline and overlook the hefty costs required to obtain it. 💸 Just because two loans show the same interest rate doesn’t mean the money leaving your pocket is the same.

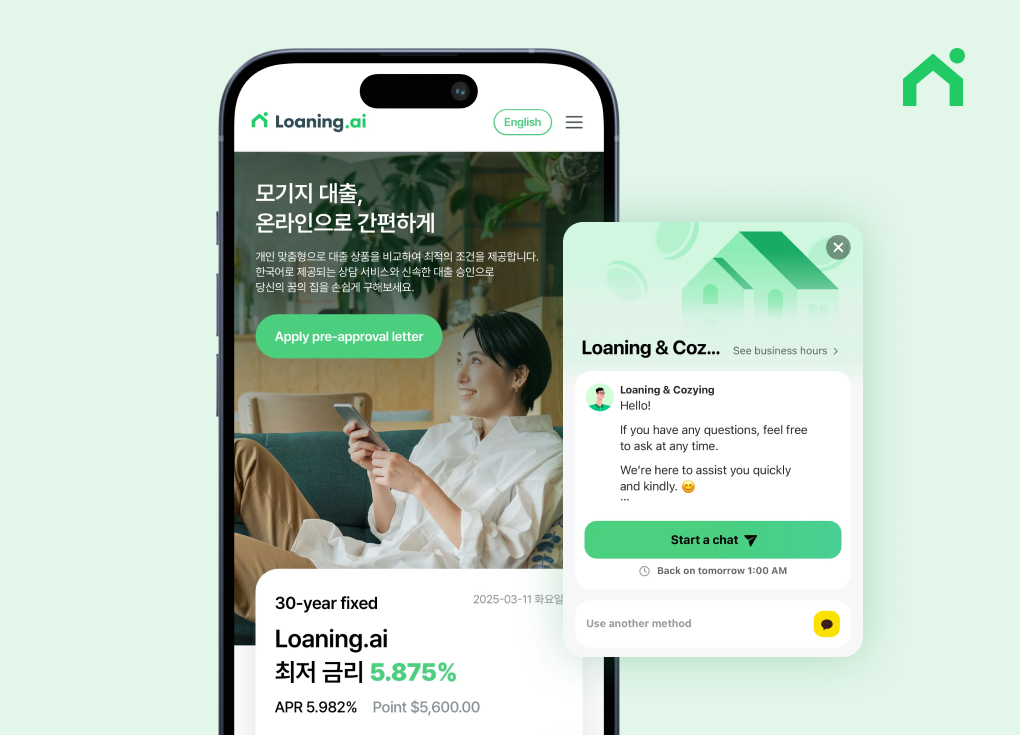

Today, we’ll uncover the hidden cost inflation behind mortgage “rate marketing” and explain how Loaning.ai delivers genuinely competitive pricing.

.

Why Buyers Focus on 30-Year Fixed Mortgage Rates

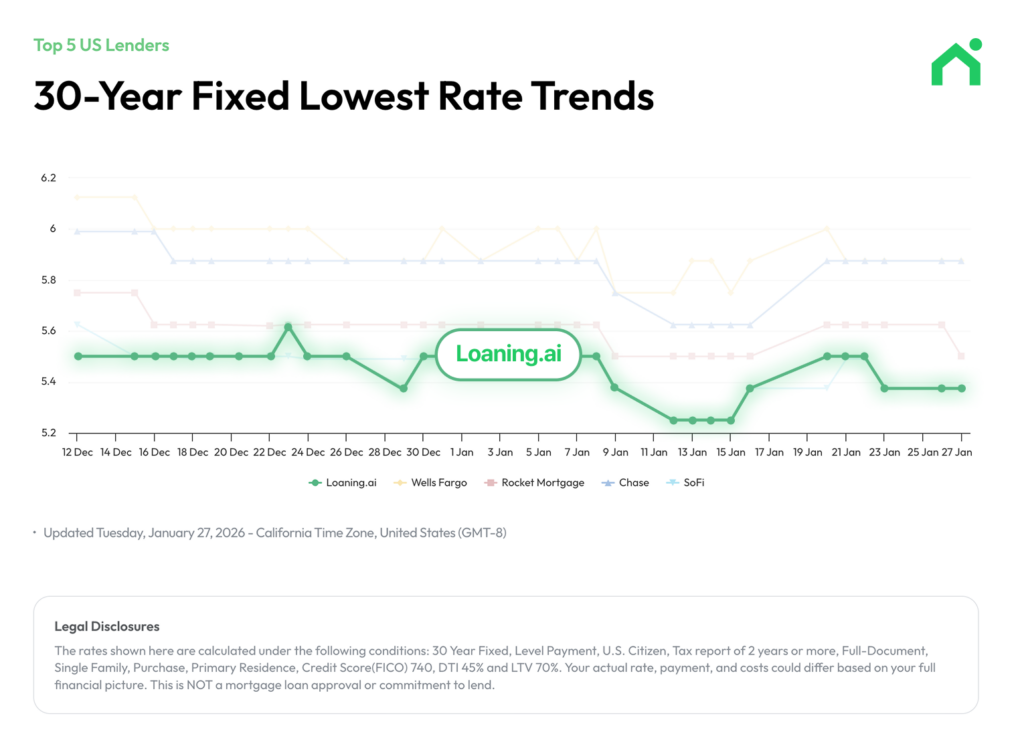

As shown in the graph above, even as rates change daily, the unwavering standard in the U.S. mortgage market is the 30-year fixed rate.

Most buyers choose this option without much hesitation—and for good reason.

.

The Hidden Side of 30-Year Fixed Mortgage Rates: The Trap You Don’t See—Points

If Lender A offers a 30-year fixed mortgage rate of 5.0% and Lender B offers 5.5%, which would you choose?

Most buyers would pick Lender A. However, if you fail to check the points, you could end up with a loan that is actually more expensive than the 5.5% option.

Points are essentially prepaid interest—you pay upfront to buy down your rate.

Typically, paying 1% of the loan amount (one point) lowers the interest rate by about 0.25 percentage points.

Some lenders require borrowers to purchase excessive points in order to attract them with artificially low advertised rates.

You might choose Lender A for its 5.0% rate, only to discover $10,000–$20,000 in discount points listed under closing costs.

Loaning.ai calls this practice “rate-marketing inflation.”

Not necessarily. If you plan to live in the home for more than 10 years and have sufficient cash reserves, purchasing points may make sense over the long term.

The issue arises when lenders impose points without considering the borrower’s situation—simply to make the rate look lower.

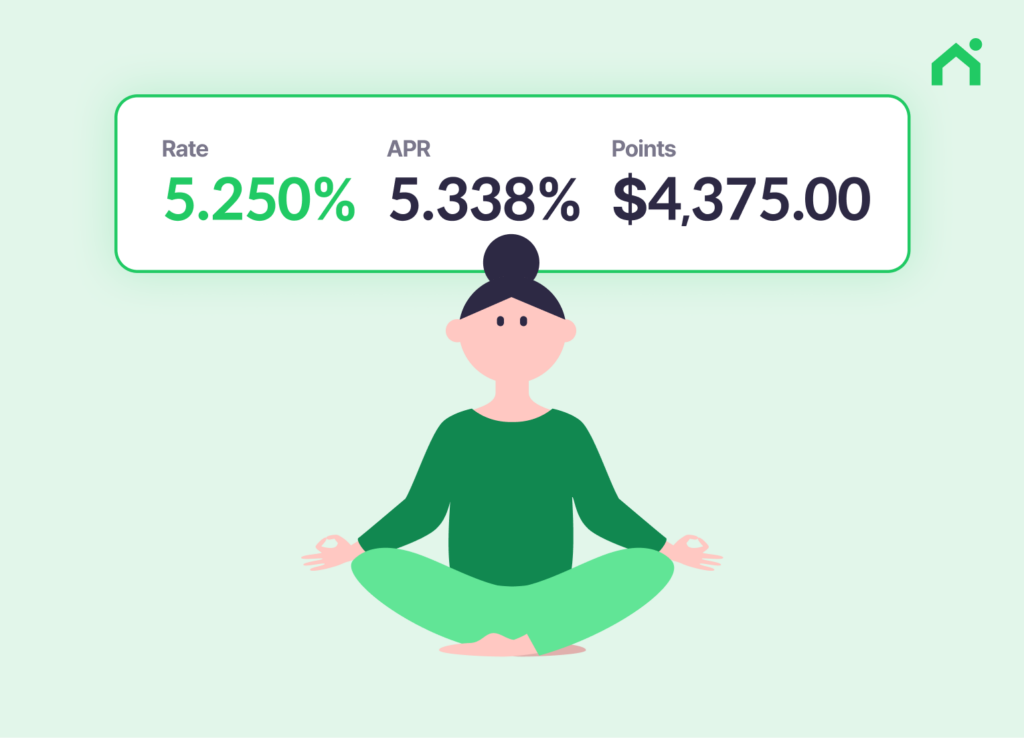

Loaning.ai provides strategic guidance on whether purchasing points makes sense based on your homeownership plans.

.

30년 고정 모기지 실전 시뮬레이션: 같은 5.5%라도 $11,000 차이?

50만 달러 대출을 기준으로, 아래 표를 확인해 보겠습니다.

| Category | Competitor | Loaning.ai | Difference (Savings) |

|---|---|---|---|

| Interest Rate | 5.500% | 5.500% | Same |

| Points Cost | $14,581 | $3,500 | Loaning.ai is significantly lower |

| APR(Annual Percentage Rate) | 5.735% | 5.577% | Lower with Loaning.ai |

| Final Outcome | High-cost structure | $11,081 saved upfront | About $11K |

Both lenders offer an attractive 5.500% 30-year fixed mortgage rate.Monthly payments are identical.

However, the upfront cost for points differs by $11,081.

That $11,081—money you would have been required to pay to the competitor—stays in your bank account when you choose Loaning.ai.

Wouldn’t it be wiser to use that money for new furniture or to build an emergency fund?

.

Loaning.ai‘s Mission

What Loaning.ai can confidently promise is cost efficiency and transparency.

Many buyers come to us after reviewing quotes from large fintech platforms or well-known mortgage banks. On the surface, the rates may look similar—but once you break down the costs required to secure those rates, the structure often tells a very different story.

✅ Why Loaning.ai?

- ✓ We use AI technology to dramatically streamline complex and inefficient lending processes.

- ✓ We’ve eliminated outdated steps and inflated fee structures through innovation.”

We pass those savings directly to customers through transparent, competitive 30 year fixed mortgage rates—that’s exactly why Loaning.ai is the smartest, most rational lending partner. ✨

.

![Things to Check When Your Closing Disclosure and LE Don’t Match [Mortgage Guider Ep. 6]](https://blog.loaning.ai/en/wp-content/uploads/2026/01/6-350x250.jpg)

![Revised LE & Rate Lock: What to Do and When [Mortgage Guide Ep. 5]](https://blog.loaning.ai/en/wp-content/uploads/2026/01/5-350x250.jpg)