Lender Credits are cash incentives provided by a lender in exchange for choosing a slightly higher interest rate when purchasing a home in the U.S.

Most buyers instinctively look for the ‘lowest possible rate,’ but depending on your situation, lender credits can be a smart strategy that saves you thousands in upfront costs.

Today, Loaning.ai clearly explains lender credits and points—and how to use them effectively to dramatically reduce your upfront costs.

.

Lender Credits and Points: What’s the Difference?

Let’s first clarify the difference between two commonly confused terms:

✓ Points: Prepaid interest—paying money upfront today to lower your future mortgage rate.

.

When Lender Credits Make Sense: Short-Term Plans & Cash Preservation

You might think, “Why would I pay a higher rate just to get lender credits?”

But in the following two situations, lender credits can become a powerful financial tool.

✓ If you pay a large amount upfront to secure a lower rate but sell before recouping those costs, you lose money.

In that case, raising the rate slightly to reduce upfront costs can be financially smarter.

✓ If your bank balance is tight after your down payment, increasing your rate slightly to receive thousands of dollars in lender credits can help cover closing costs and protect your liquidity.

.

Real-World Simulation: Calculating the Break-Even Point

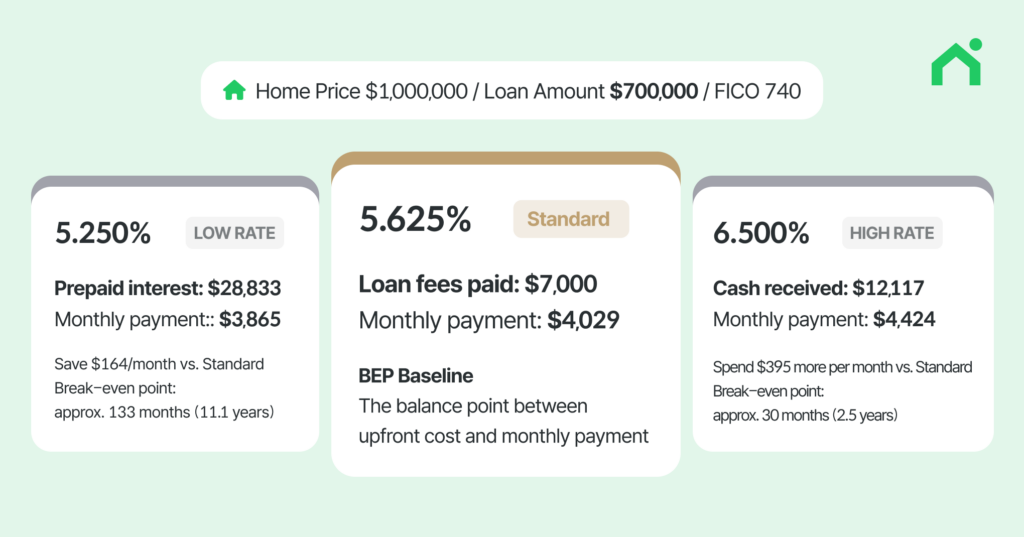

Hearing about it isn’t enough—so Loaning.ai ran a simulation based on a $700,000 loan, comparing three interest rates: 5.250%, 5.625%, and 6.500%.

The key metric here is the break-even point.

| Category | Option 1 | Option 2 (Recommended ✨) | Option 3 |

|---|---|---|---|

| Rate | 5.250% | 5.625% | 6.500% |

| APR | 5.618% | 5.741% | 6.311% |

| Monthly Payment | $3,865 (Lowest) | $4,029 | $4,424 |

| Upfront Cost |

Pay $28,833 (to buy down rate) |

Pay $7,000 (Origination) |

Receive $12,117 (Credits) |

| Break-Even Point (BEP) |

~11.1 years (133 months) | ~4 years 1 month | ~2.5 years (30 months) |

| Analysis | Lowest payment, but takes 11+ years to recover the upfront cost($28,833). | Balanced option with reasonable rate and low upfront cost. | Pay $395 more monthly but get $12,117 upfront.(ideal for short-term plans) |

Option 3 has the highest monthly payment, but remains advantageous for the first 2.5 years due to the $12,117 in lender credits..

If you expect to move or refinance within that window, this can be the smartest choice.

However, the longer you stay, the more attractive Option 2 becomes. Its break-even point is approximately 4 years and 1 month—after that, the lower rate pays for itself.

.

Lender Credits Are Essential If You’re Planning to Refinance

If you expect rates to fall within the next year or two—or if you’re planning to move soon—it may not make sense to spend heavily buying down today’s rate.

If you refinance before reaching Option 1’s 11-year break-even point, all prepaid costs are essentially wasted.

Instead, choosing Option 3 allows you to pocket $12,117 upfront and refinance into a lower rate before the 30-month break-even—making it far more advantageous.

.

Find your ideal mortgage with Loaning.ai

“How long do you plan to stay in this home? Are you considering refinancing soon?”

Loaning.ai always asks these two questions first—because depending on your answers, lender credits can either be a trap to avoid or a strategy that puts over $10,000 in your pocket.

Mortgages last 30 years—but life changes much faster.

The lowest advertised rate might actually lock you into unnecessary costs for over a decade.

If you’re planning a short stay or considering a refinance, calculate your true break-even point with Loaning.ai.

![Things to Check When Your Closing Disclosure and LE Don’t Match [Mortgage Guider Ep. 6]](https://blog.loaning.ai/en/wp-content/uploads/2026/01/6-350x250.jpg)

![Revised LE & Rate Lock: What to Do and When [Mortgage Guide Ep. 5]](https://blog.loaning.ai/en/wp-content/uploads/2026/01/5-350x250.jpg)