Have you ever sat in a taxi on the way to your destination, anxiously watching the meter tick up?

Just a few years ago, we had no way of knowing the exact fare until we arrived.

We worried that traffic might drive the price higher or that the driver might take a longer route. The entire ride was filled with uncertainty.

Today, things are different.

Before getting in, we can check the estimated fare from pickup to destination.

The essence of “travel” hasn’t changed, but one small difference—knowing the cost upfront—has completely transformed the experience.

Where uncertainty once existed, trust and peace of mind now remain.

.

So what about buying a home—the biggest financial decision of a lifetime? 🧐

Today’s mortgage market, where hundreds of thousands of dollars are at stake, still resembles those old taxi rides.

Complex fees you can’t see before consulting, terms that change as the process moves forward, and vague answers like, “You’ll know once we proceed.”

Many borrowers reach the final signing stage still wondering,

“Is this really the best choice?”

This is exactly where Loaning.ai begins.

Our mission is simple and clear:

“Reduce the true financial cost for our customers.”

At Loaning.ai, “financial cost” doesn’t just mean the money leaving your bank account.

Of course, visible costs like interest rates and fees must be reasonable.

But just as important are the hidden costs—

the confusion caused by missing information,

the stress created by opaque processes,

and the anxiety of making decisions without clarity.

All of these are unnecessary financial burdens borne by the customer.

.

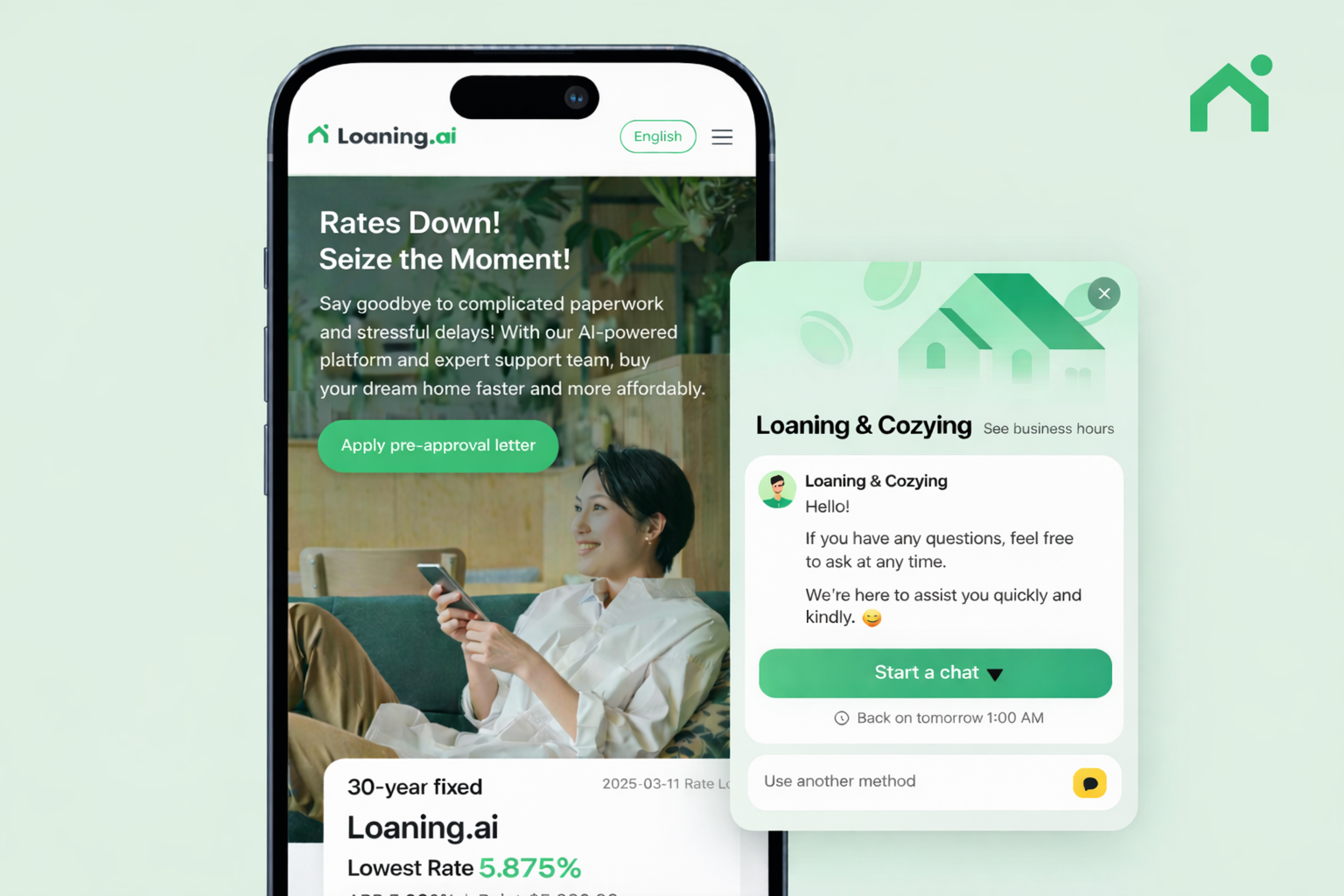

How Loaning.ai Delivers Smarter, Fairer Rates ✨

Low advertised rates often hide excessive upfront fees known as ‘points.

Even when rates look identical, the total cost to the borrower can vary dramatically.

Loaning.ai clearly discloses rate and point structures so you don’t fall into a “numbers trap.”

Traditional mortgage processes rely heavily on manual paperwork and data entry. The time and labor costs from these inefficiencies are often passed on to borrowers.

Loaning.ai automates these steps with technology, and the savings are returned to you as better terms—not absorbed as profit.

Loaning.ai operates as a Direct Lender, without intermediary brokers. Just as farm-to-table ingredients are fresher and more affordable, fewer distribution layers in finance mean more benefits for the customer. No middle margins—this is the foundation of fair pricing.

.

Finance You Can Truly Choose

Just as you check a fare before entering a car, Loaning.ai shows you all the terms before the process begins.

Your exact terms, your monthly payment, and any hidden costs—all shown clearly and upfront.

Not products wrapped in flashy promises, but the most honest and streamlined option available.

That is how Loaning.ai defines real financial savings.

.

.