✓ Common refinance cost items

✓ How to use lender credits to reduce upfront costs

✓ How to calculate your break-even point

When you hear that interest rates have dropped, refinancing may sound appealing—but unexpected closing costs often cause hesitation. Trying to save on interest while facing thousands in refinance fees can feel discouraging.

In today’s Loaning.ai blog, we break down the specific components of refinance fee and explain how to use lender credits to reduce your upfront cash outlay.

.

What Costs Are Included in a Refinance?

Refinance costs (often called refinance fee or closing cost) are real service fees paid to the professionals involved in issuing your loan.

These generally fall into three main categories.

: These are administrative costs charged by the lender to process your loan.

✓ Includes processing fees for document preparation and underwriting fees for loan review.

: Mandatory fees paid to external service providers—not the lender.

✓ Appraisal Fee: Fee paid to a licensed appraiser to determine the property’s value(typically $600–$1,000).

✓ Credit Report Fee: Fee paid to credit bureaus for reviewing your credit history.

: Required fees paid to third-party institutions for legal and record-keeping purposes.

✓ Includes title insurance to protect ownership rights and recording fees to officially register the loan.

All of these costs are disclosed upfront in the legally required Loan Estimate (LE) document.

.

How to Reduce Refinance Costs: Points vs. Lender Credits ✨

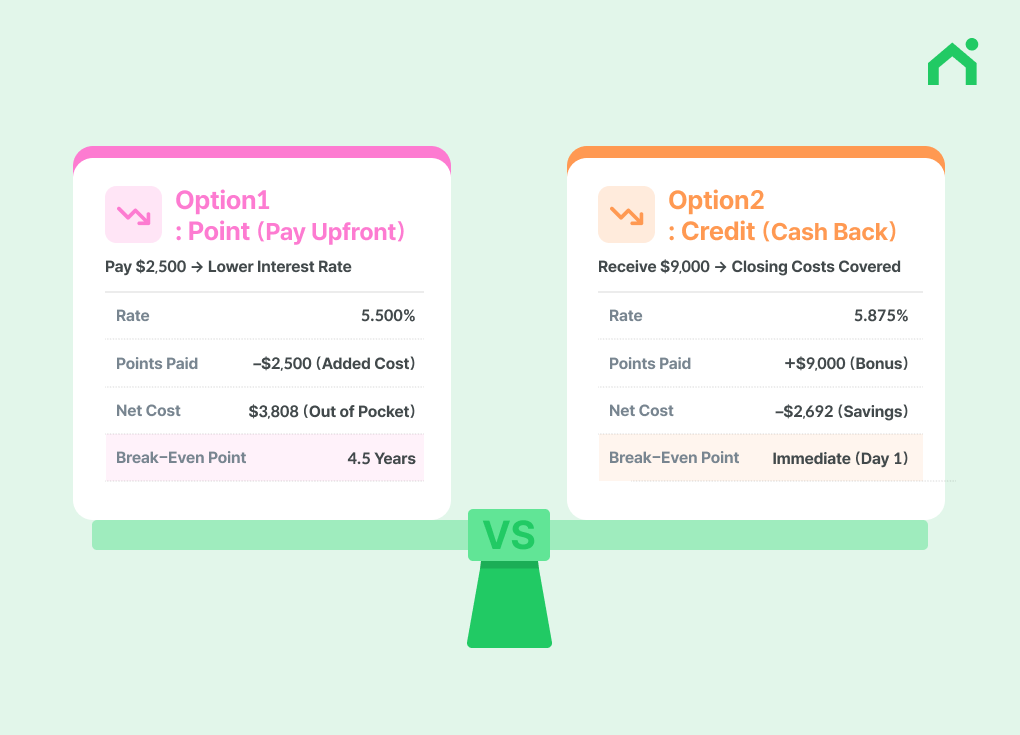

“If I’m willing to pay a bit more now, can I reduce my monthly payment?”

✓ You pay points upfront at closing in exchange for a lower interest rate.

✓ Pros: Higher upfront cost, but lower monthly payments and significant long-term interest savings.

✓ Best for: Borrowers planning to stay in the home for 5+ years or those with sufficient cash reserves.

“I want to minimize my upfront cash and reduce out-of-pocket expenses.”

✓ You accept a slightly higher interest rate in exchange for lender-provided credits that offset closing costs.

✓ Pros: Helpful when cash is needed for other expenses such as tuition or medical bills.

✓ Best for: Borrowers prioritizing lower upfront costs or planning to move or refinance again in a few years.

✓ 30-Year Fixed, Level Payment, U.S. Citizen

✓ Full documentation with 2+ years of tax returns

✓ Single-family home, refinance, primary residence

✓ Credit Score (FICO): 740, DTI: 45%

✓ APR: Option 1 (5.570%), Option 2 (5.811%)*

Option 1: Includes $2,500 in points, resulting in an APR (5.570%) higher than the interest rate.

Option 2: Includes $9,000 in lender credits that fully offset closing costs, resulting in an APR (5.811%) lower than the interest rate.

* All figures are simulations and may vary based on market conditions at the time of application.

.

Experience Transparent Refinancing

Successful refinancing isn’t about choosing the lowest rate—it’s about finding the right cost structure for your situation.

Loaning.ai provides transparent comparisons of rates, refinance fees, points, and lender credits based on your financial goals and homeownership plans—so you can make confident, informed decisions.

.