✓ What is Warrantability?

✓ Must-check HOA requirements for approval

✓ Frequently asked questions

“My friend with a single-family home refinanced at a lower rate—so why is refinancing my condo so difficult?”

In the U.S., a condo is not just your home—it’s part of a shared building. Because of that, condo refinance guidelines are different from standard home refinancing.

That’s why we created this guide.

Loaning.ai breaks down the key requirements and approval strategies for condo refinancing in a clear and simple way.

.

Condo Refinance Approval Depends on “Warrantability”

When lenders evaluate a single-family home, they focus on two things:

- The value of the home

- The borrower’s financial strength

For condos, there’s a third factor: the financial and structural health of the building itself.

This is called Warrantability ✨

.

What Is Warrantability in U.S. Mortgage Lending?

Warrantability is essentially a report card on how well a condo community is managed and maintained.

Government-sponsored entities like Fannie Mae only allow standard, low-rate mortgages for condos that meet their warrantability guidelines.

That means even with an 800 credit score, your condo refinance can be denied if the building itself is deemed non-warrantable.

.

How Lenders Evaluate Condo Refinance Eligibility

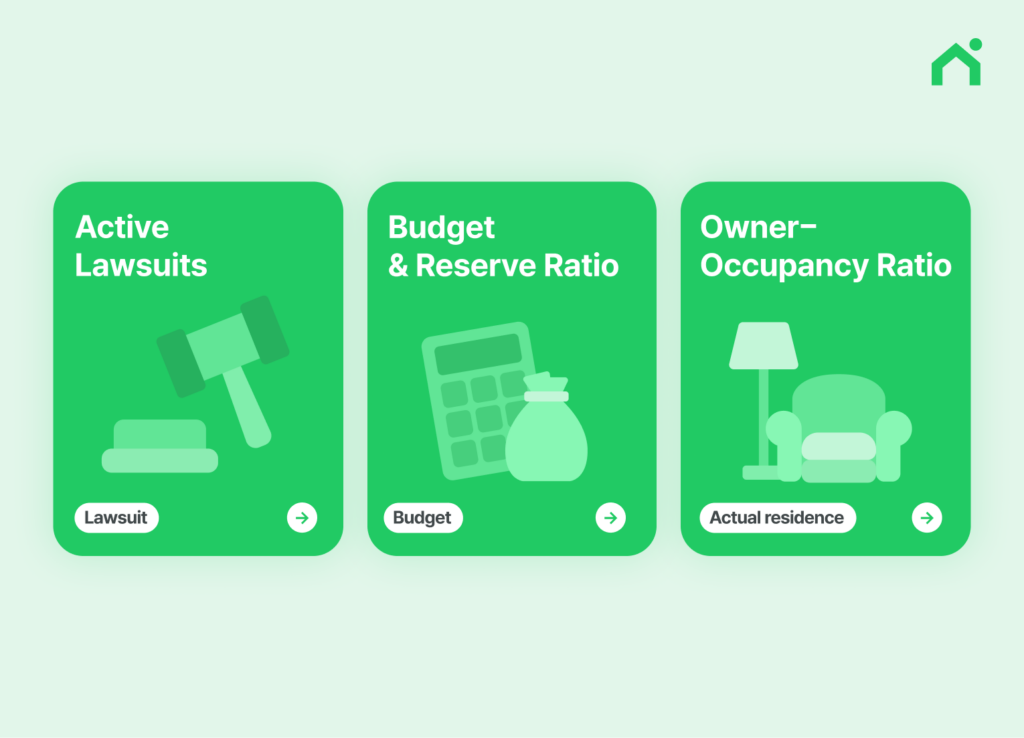

Below are three of the most common HOA-related factors lenders review:

① Active Lawsuits

If the HOA is involved in litigation—especially related to structural defects—refinancing becomes extremely difficult. This is one of the most common reasons for denial.

② Budget & Reserve Ratio

Does the HOA maintain adequate reserves for repairs?

Lenders generally expect at least 10% of the annual budget to be set aside. Poor reserves increase risk and reduce approval chances.

③ Owner-Occupancy Ratio

If too many units are rented out, lenders see higher risk.

Ideally, 50% or more of the units should be owner-occupied. This ratio is even more critical for investment-property condo refinances.

.

How Much Does Condo Refinance Cost?

If current market rates are 0.75%–1% lower than your existing mortgage, refinancing may make sense.

However, condo rates can be slightly higher than single-family homes, so it’s critical to calculate the break-even point, including closing costs.

| Category | Current Loan(Before) | Option 1 |

Best Balance

Option 2(Recommended)

|

Option 3 | Option 4(No Out-of-Pocket) | Option 5(Cash Back) |

|---|---|---|---|---|---|---|

| Interest Rate(Rate) | 7.125% | 5.500% | 5.625% | 5.750% | 5.875% | 5.990% |

| APR | 7.125% | 5.547% | 5.634% | 5.762% | 5.840% | 5.918% |

| Monthly Payment(P&I) | $4,716 | $3,975 | $4,030 | $4,085 | $4,141 | $4,192 |

| Monthly Savings | – | $741 | $686 | $631 | $575 | $524 |

| Net Cost | – | $3,808 | $708 | $1,008 | -$2,692(receive cash) | -$5,692(receive cash) |

| Break-Even Period(BEP) | – | 5.1 months | 1.0 month | 1.6 months | Immediate savings | Immediate savings |

| Total Savings(30년) | – | $266,760 | $246,960 | $227,160 | $207,000 | $188,640 |

: These are pure administrative fees charged by the lender to process your loan.

✓ Underwriting Fee: The cost of thoroughly reviewing your income, assets, and credit.

✓ Processing Fee: The cost of preparing, collecting, and reviewing all required documents.

: Mandatory fees paid to external professional service providers, not the lender.

✓ Appraisal Fee: Paid to a licensed appraiser to determine the property’s market value. (Typically $600–$1,000)

✓ Credit Report Fee: Charged by credit bureaus for accessing your credit report.

: Required fees to verify and protect property ownership.

✓ Title Insurance: Insurance that protects against ownership disputes. (Typically $600–$1,000)

✓ Escrow / Settlement Fee: Covers secure handling and transfer of funds during closing.

: Mandatory fees paid to the state or county.

✓ Recording Fees: Fees for officially recording the new loan with the local government.

Use lender credits. By accepting a slightly higher interest rate, you can receive credits from the lender to fully offset the closing costs listed above. This is one of the smartest ways to secure liquidity without paying any cash upfront.