If you are planning to buy a home in the United States, the very first thing you should understand is the MLS (Multiple Listing Service).

The MLS is the official real estate database where licensed agents across the U.S. register and share property listings. It is not just a search tool. It contains the core data needed for home buying decisions, including accurate market prices, school district information, appraisal benchmarks, tax records, and more.

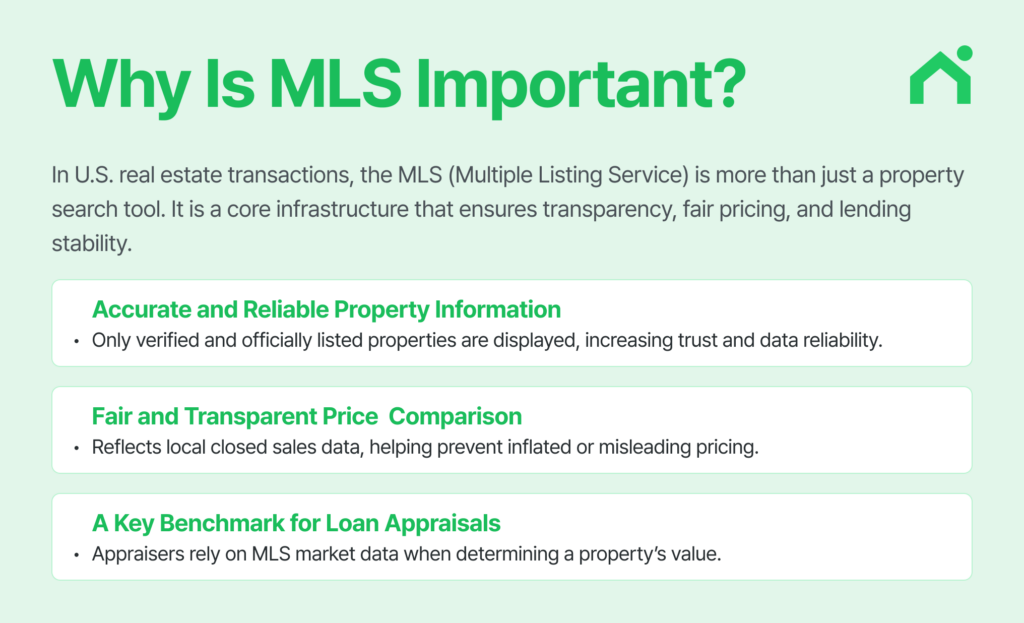

Why Is MLS Important?

In U.S. real estate transactions, the MLS (Multiple Listing Service) is more than just a property search tool. It is a core infrastructure that ensures transparency, fair pricing, and lending stability.

- Accurate and Reliable Property Information

Only licensed real estate agents can register properties in the MLS.False listings, duplicate entries, or unauthorized uploads are not allowed.Unlike online portals that may show outdated or duplicated listings, MLS displays only actively available properties. This significantly increases reliability. - Fair Market Price Comparisonㅋ

MLS provides real transaction data by neighborhood and ZIP code. This allows buyers to filter out overpriced listings or inflated asking prices. It is the most important reference for determining whether a home is priced fairly. - The Standard for Loan Appraisals

Banks and lenders use MLS market data to determine property appraisal value during loan underwriting. In other words, MLS is not simply a listing platform—it’s a trusted, authoritative database that directly impacts financial decisions.

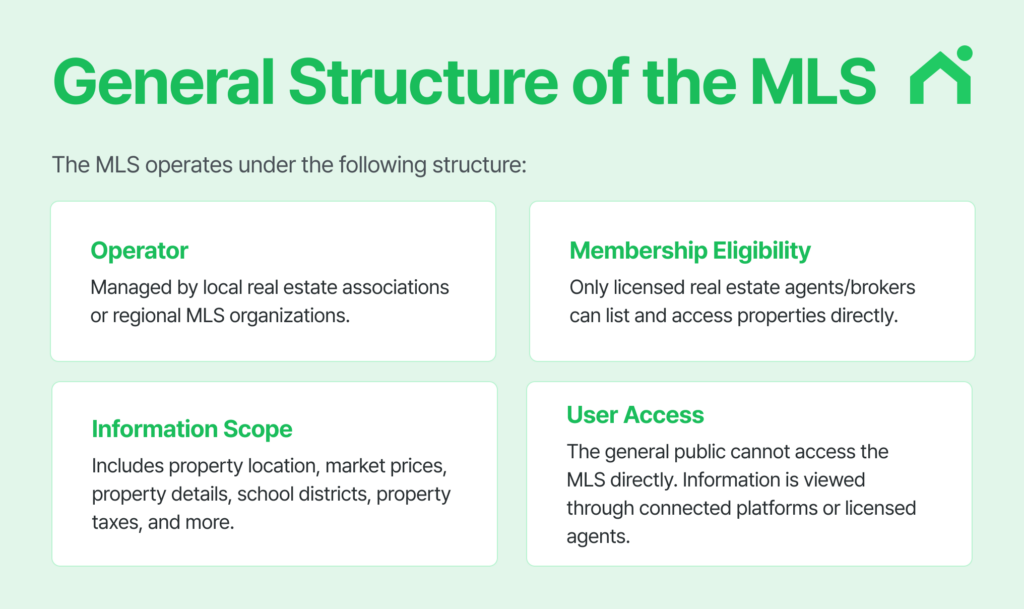

How Is MLS Structured?

MLS operates under a structured system:

- Operator – Local real estate associations or regional MLS organizations.

Local Realtor associations or regional MLS groups manage each system. There are hundreds of regional MLS systems across the U.S., each tailored to local market conditions. - Membership Eligibility – Only licensed real estate agents/brokers

MLS is not an open platform accessible to the public. Only licensed real estate agents holding government-issued credentials can list properties, ensuring strict control over accuracy, reliability, and data integrity. - Information Scope

MLS listings include comprehensive property data:- Location, lot size, building structure

- Historical sales prices and price changes

- School district details

- Property tax records

- HOA information

- Market status updates

- User Access

Consumers cannot directly access MLS databases. Instead, information is available through licensed agents or MLS-integrated platforms. This prevents misinformation and ensures data accuracy.

Related Platform Comparison

| Term | Description |

|---|---|

| Zillow, Redfin, etc. | Real estate portals that pull some MLS data but do not provide real-time updates; may include unofficial or outdated listings. |

| Private Listing Data | Individually uploaded listings; unclear transaction history with potential for duplicate or inaccurate listings. |

| MLS-Integrated Platforms | Services like Loaning.ai that provide real-time MLS data along with additional information such as school ratings, property taxes, and other key details. |

Why You Must Understand MLS

- If a property is priced above the MLS market value and you don’t realize it → you may overpay.

- If you sign a contract for a property not registered in MLS → risk of title issues, duplicate listings, or even a void transaction.

- If the appraisal comes in lower than the MLS market value → your loan amount may be reduced or denied.

- If you decide without checking school district or community data → lower resale value and potential disadvantages for education and local infrastructure.

Example:

The MLS market value in the same ZIP code is $680,000, but you sign a contract for a property you saw on Zillow for $730,000.

→ During loan underwriting, the appraisal comes in at $680,000, reducing your loan amount to $540,000.

→ You must cover the $190,000 difference out of pocket or cancel the contract.

What You Must Check Before Buying a Home

- Review MLS-based listings first.

Don’t rely only on portal searches. Verify accurate pricing and conditions through properties officially registered in the MLS. - Check your budget before searching.

Before looking for homes, use Loaning.ai to determine what price range fits your financial situation and plan accordingly.

MLS vs Other Real Estate Platforms

| Category | MLS | Zillow / Trulia |

|---|---|---|

| Listing Access | Licensed agents only | Anyone may upload |

| Data Reliability | Very high | May include duplicate or outdated listings |

| Update Frequency | Real-time | May be delayed |

| Loan Eligibility | Provides appraisal-based valuation standards | Not clearly tied to lending standards |

| School & Tax Info | Detailed information provided | Limited information available |

Why Does This Matter?

MLS is not just a property search tool. It is critical data that directly impacts your loan strategy, resale value, and school district decisions.

Rather than focusing on short-term price differences, you should verify MLS data to manage long-term financial risk.

Important Considerations When Buying a Home

- A property you find on Zillow may already be sold or under contract in the MLS.

- MLS-based listings have higher credibility and better appraisal alignment, which improves your loan approval odds

Frequently Asked Questions (FAQ)

Q. Are MLS listings more expensive?

No. MLS prevents price manipulation and fake listings, reducing the risk of overpaying.

Q. Where can I view MLS listings?

Through licensed agents or MLS-integrated platforms.

Q. Does MLS status affect loan approval?

Yes. Appraisal values are based on MLS data, directly influencing loan limits.

MLS in One Sentence

- MLS is the official database of U.S. real estate listings.

- It serves as the primary reference for appraisals, market pricing, property details, and school information.

- Relying on unofficial listings can lead to risks such as loan denial, failed transactions, or overpaying.

- Always verify property information through an MLS-connected platform before signing a contract.

Planning to Buy a Home in the U.S.?

Loaning.ai provides the latest 2025 mortgage and home buying guides to help you navigate the process with confidence.