What Is a Repayment Schedule?

When buying a home, you should carefully review your repayment schedule starting from the loan selection stage after pre-approval through closing. It allows you to compare loan products, evaluate your monthly budget, and make informed long-term ownership decisions based on your total payment and total interest cost.

This type of payment breakdown goes beyond comparing interest rates — it becomes the foundation of your financial planning.

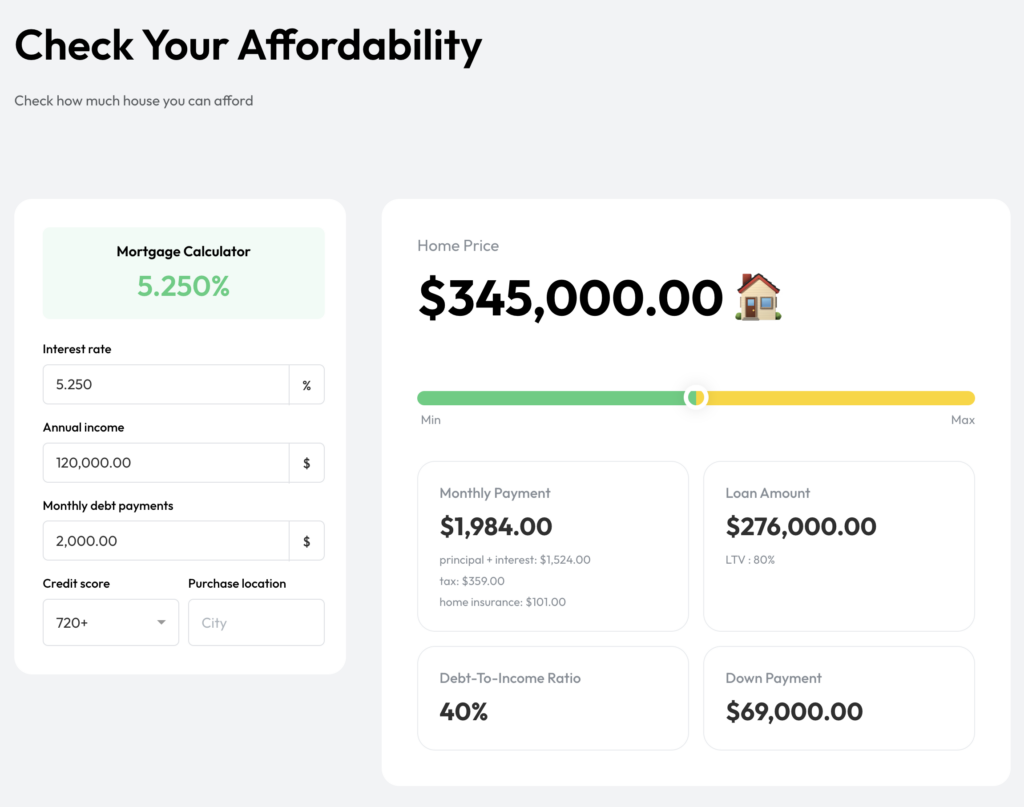

- True Monthly Cost: Review the total cost (PITIA), not just Principal & Interest (P&I)

- Total Cost Analysis: The total interest you will pay over the life of the loan

Because it presents these factors together, this structured payment overview helps you determine how long to keep the home, whether refinancing makes sense, and how to structure your investment or occupancy strategy.

Key Components Explained

- Date: When your payment is due

- Breakdown: How much goes to interest vs. principal

- Balance: Remaining loan amount after each payment

- PITIA Option: Total monthly housing cost including taxes and insurance

Looking at mortgage rates alone can make it tempting to judge whether a deal is “good” or “bad” based on instinct. But the repayment schedule shows you—in real numbers—how your actual payment burden varies, even at the same rate, based on points, loan term, and repayment type (principal + interest vs. interest-only).

So while a rate sheet gives you a sense of the market, this detailed breakdown is your real-world financial simulation—showing exactly what leaves your bank account each month.

Common Mistakes Before Signing a Mortgage

✅ Where exactly is my money going? (P&I vs PITIA)

Do not look at Principal & Interest alone. Your real budget depends on PITIA — including property taxes, insurance, and HOA dues.

✅ Should I buy points to lower the rate?

If you pay points upfront to reduce your interest rate, calculate the break-even point. You’ll only benefit if you stay in the home longer than that period.

✅ Can I pay off my loan early? (Prepayment)

If you want to pay down the principal faster—for example, using bonus income—always check whether principal curtailment incurs a prepayment penalty.

✅ Could my monthly payment increase later?

If you choose an Adjustable-Rate Mortgage (ARM), ask how much your payment could increase after the fixed period ends (5, 7 years, etc.).

Loaning.ai lets you compare multiple lenders’ loan options—with varying APRs, points, terms, and structures—side by side. Run personalized amortization simulations to find the repayment plan that best fits your income and how long you plan to stay in your home.

“See your true monthly payments with detailed Repayment Schedule—compare easily at Loaning.ai.”

Check Your Personalized Repayment Schedule

At Loaning.ai, you can review a repayment schedule tailored to your loan conditions.

Check your repayment schedule instantly — no personal information required.

How Mortgage Payments Are Calculated (Example)

The most common mortgage structure uses fully amortized payments.

Example:

- Loan Amount: $600,000

- Term: 30 years (360 months)

- Interest Rate: 6.0% fixed

| Month | Monthly P&I | Interest | Principal | Remaining Balance |

|---|---|---|---|---|

| 1 | $3,597 | $3,000 | $597 | $599,403 |

| 12 | $3,597 | $2,950 | $647 | … |

| 60 | $3,597 | $2,700 | $897 | … |

| 120 | $3,597 | $2,400 | $1,197 | … |

Your real monthly housing cost is based on:

PITIA = Principal + Interest + Property Tax + Insurance + HOA

Key Mortgage Concepts to Understand

A repayment schedule reflects the combined impact of several core mortgage factors:

| Concept | Meaning | Why It Matters for Your Repayment Schedule |

|---|---|---|

| Interest Rate | The base rate applied to your loan | Even with the same rate, loan structure affects monthly payments and total interest |

| APR | Interest rate plus fees and points | A lower rate with a higher APR may increase total cost |

| LTV | Loan-to-Value ratio | Higher LTV may require PMI, increasing monthly cost |

| DTI | Debt-to-Income ratio | Underestimating PITIA can push DTI above approval limits |

| PITIA | Total housing payment | Determines real monthly affordability |

Review Your Payment Plan at Loaning.ai

If calculating your repayment schedule feels complicated, you can easily review it through Kakao chat.

Loaning.ai’s mortgage specialists will calculate a repayment schedule tailored to your loan scenario and financial situation.

Frequently Asked Questions (FAQ)

Q1. Can a repayment schedule affect loan approval?

Yes. If PITIA is underestimated during application and recalculated later, your DTI may exceed lender guidelines, potentially reducing your approval amount or leading to denial.

Q2. Can APR be low but the repayment schedule still show higher payments?

Yes. That is why reviewing both APR and the repayment schedule is important. Cash flow impact may differ from the advertised rate.

Q3. What happens if LTV exceeds 80%?

If LTV is above 80%, you may pay PMI or receive a slightly higher interest rate, which increases both monthly payments and total loan cost shown in the repayment schedule. Comparing FHA, Conventional with PMI, and Non-QM options is critical.

Quick Summary

A repayment schedule shows how much you pay each month, how principal and interest are divided, and how your loan balance decreases over time.

More than a simple interest comparison tool, it clearly presents your real monthly cost (PITIA), total interest paid, and long-term risk structure. When reviewed together with APR, LTV, DTI, and PITIA, a repayment schedule helps you confidently choose the mortgage structure that best fits your financial goals.

Explore Related Content