LA First-Time Homebuyer Benefits & Deductions: 3-Line Summary 🏠

- LA first-time homebuyer programs: CalHFA MyHome, LIPA, MIPA, Greenline Home Program

- Tax benefits you can receive after purchasing real estate in LA: Section 121 home sale exclusion (capital gains tax savings), SALT (state and local tax) deduction

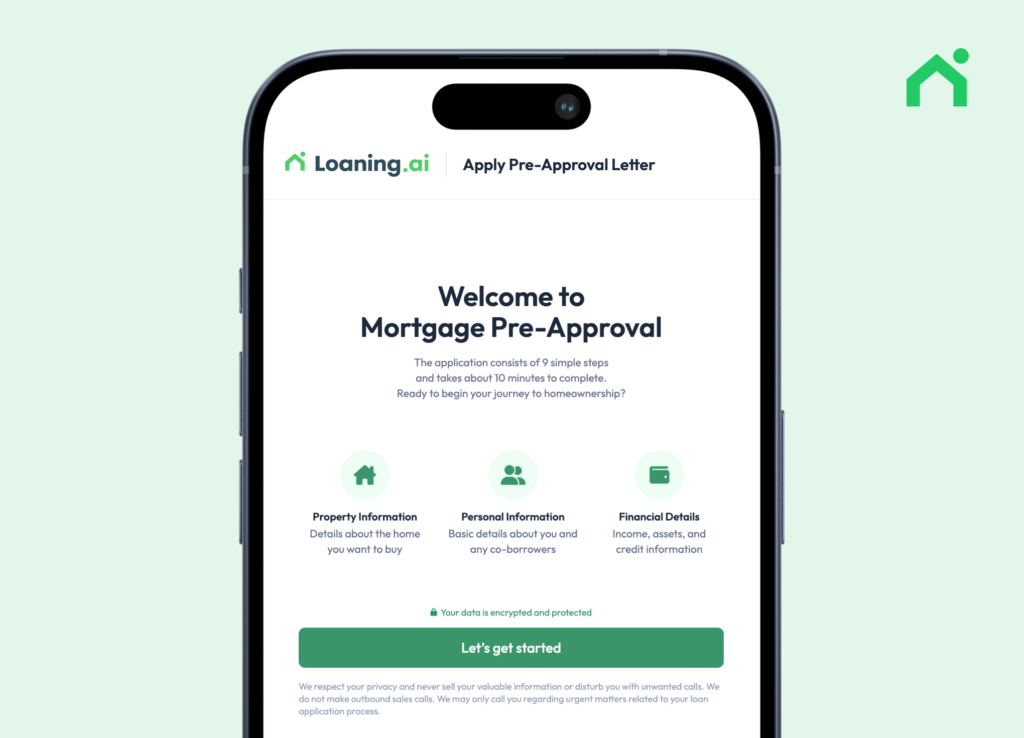

- If you need help designing a 2026 first-home purchase plan, consult with the official mortgage lender, Loaning.ai.

Have you checked out the benefits for first-time homebuyers in LA? Even for the same $800,000 property, your initial cash outlay (down payment and closing costs) and annual expenses can vary significantly depending on your qualification for first-time homebuyer programs and tax deduction options.

There are some benefits that have changed as of 2026, so use Loaning.ai to check everything at once, from first-time homebuyer promotions to post-purchase deductions and tax-exempt benefits!

Classification of LA First-Time Homebuyer Benefits

How Does LA Define a ‘First-Time Homebuyer’?

In general, a first-time homebuyer is defined as someone who has not owned a home at any point during the past three years.

First-time homebuyer benefits can be broadly divided into two categories.

- – CalHFA MyHome Assistance Program, LIPA, MIPA, Greenline Home Program

- – SALT (state and local tax) deduction

- – Section 121 home sale exclusion when selling the home, etc.

2026 LA Down Payment & Closing Cost Assistance Programs

In addition to programs from the State of California Housing Finance Agency (CalHFA), both the Los Angeles Housing Department (LAHD) and Los Angeles County Department of Consumer and Business Affairs (DCBA) operate a variety of support programs to help people become homeowners.

Let’s start with the most well-known CalHFA MyHome Assistance Program, and then look at what kinds of programs each local government is running.

1️⃣ CalHFA MyHome Assistance Program: Representative First-Time Homebuyer Support

| CalHFA MyHome Assistance Program | Details |

|---|---|

| Eligibility | New homebuyers who have had no ownership interest in real property at all during the past 3 years |

| Use of funds | Assistance for down payment and closing costs |

| Assistance cap |

– For FHA and other government-insured loans: up to 2.5% of the purchase price or appraised value – For conventional loans: up to 3% of the purchase price or appraised value |

| Repayment | When the home is sold or ownership is transferred, upon refinance, or when the mortgage is paid off |

2️⃣ LAHD LIPA (Low Income Purchase Assistance): First-Home Support for Low-Income Buyers

| LAHD LIPA (Low Income Purchase Assistance) | Details |

|---|---|

| Eligibility |

– New homebuyers who have had no ownership interest in real property during the past 3 years – U.S. citizens, permanent residents, or other qualified foreign nationals – Minimum middle FICO credit score of 660 |

| Use of funds | Assistance for down payment and closing costs |

| Assistance cap |

– Up to $161,000 in loan assistance for down payment, closing costs, and acquisition costs – Interest-free |

| Repayment | When the home is sold or ownership is transferred, upon refinance, or when the mortgage is paid off |

3️⃣ LAHD MIPA (Moderate Income Purchase Assistance): Support for Moderate-Income Buyers

| MIPA (Moderate Income Purchase Assistance) | Details |

|---|---|

| Eligibility |

– New homebuyers who have had no ownership interest in real property during the past 3 years – U.S. citizens, permanent residents, or other qualified foreign nationals – Minimum middle FICO credit score of 660 |

| Use of funds | Assistance for down payment and closing costs |

| Assistance cap | Interest-free loan of up to $115,000 for down payment, closing costs, and acquisition costs |

| Conditions |

– Completion of an 8-hour homebuyer education course – Completion of homebuyer counseling with one of the LAHD-approved providers |

4️⃣ Greenline Home Program – County-Based Cash Assistance

| Greenline Home Program | Details |

|---|---|

| Eligibility |

– New homebuyers residing in Los Angeles County – New homebuyers who have had no ownership interest in real property during the past 3 years – Low- to moderate-income residents |

| Benefit | Grants of up to $35,000 to assist with down payment and closing costs |

| Conditions | Completion of an 8-hour homebuyer education course |

** Each program is subject to budget availability and changes in laws and ordinances. Therefore, the conditions, details, and application periods can change frequently each year. It’s always best to confirm your actual eligibility and timing through a professional.*

2026 LA Homebuyer Tax Deduction Benefits

In addition to **Prop 13 (**California’s property tax protection mechanism that limits annual property tax increases to a maximum of 2% per year), there are several important deduction and exclusion rules you can use on your year-end tax return after buying a home.

1️⃣ Section 121 Home Sale Exclusion: Save Capital Gains Tax

When you sell your home, you need to pay more attention to capital gains tax (income tax) than to property tax.

If you use the rules well, you can keep a significant portion of your profit.

| Section 121 Home Sale Exclusion | Details |

|---|---|

| Type | Saving on capital gains tax |

| Condition | You must have used the property as your principal residence for at least 2 years out of the 5 years before the sale |

| Benefit |

You can exclude up to $500,000 of gain when selling your home. – Single filer: exclusion of up to $250,000 – Married joint filers: exclusion of up to $500,000 Can generally be applied once every two years |

2️⃣ SALT (State and Local Tax) Deduction: Expanded in 2026

| SALT (State and Local Tax) Deduction | Details |

|---|---|

| Type | Deduction for state income tax, real estate (property) tax, and personal property tax |

| Condition |

– The taxpayer must choose itemized deductions – The taxpayer must have actually paid state income tax, property tax, and/or personal property tax |

| Benefit |

By deducting property tax and state income tax from federal taxable income, you can reduce your overall tax burden. Due to the passage of the OBBBA bill in 2025, the SALT deduction limit has been increased for 2026: – 2025: $40,000 – 2026: $40,400 (planned 1% increase per year) |

Have You Reviewed the 2026 LA First-Time Homebuyer Benefits & Tax Deductions?

If you’re curious which first-time homebuyer programs and tax deduction/exclusion items are actually available in your own situation, check on Loaning.ai, a mortgage lender specializing in Korean clients.

Based on your profile, budget, and timeline, we’ll help you design a 2026 first-home purchase plan together.

* This article provides general information intended to help readers understand real estate, mortgage, and tax-related topics in Los Angeles. It should not be interpreted as tax, legal, lending, or investment advice. No tax, financial, or real estate decisions should be made based solely on this article.

* The actual application and effect of SALT deductions, mortgage interest deductions, Section 121 exclusions, CalHFA / LAHD programs, etc. can vary significantly depending on an individual’s income, place of residence, loan structure, and other personal circumstances, and relevant laws and program conditions may change from year to year.

* Before making any major decisions, consult with qualified professionals (CPA, legal advisor, or official mortgage lender). The information in this article is based on the situation as of the date of writing and may change without prior notice.