📝 Key Takeaways of Third Party

- What happens in the Third-Party stage

Appraisal, Title, HOA, and Homeowner’s Insurance providers evaluate the property’s value and legal safety. Their results become core data for the final Underwriting review. - Insurance selection matters

Choosing your insurance company early and keeping track of deadlines can significantly reduce delays and risks in the Third-Party stage.

The Third-Party verification stage is where the most unexpected issues can surface. Many buyers especially worry about one situation: “What do I do when the appraisal comes in lower than the purchase price?”

In this guide, we will explain available options plus the key steps to surviving the Third-Party stage without trouble.

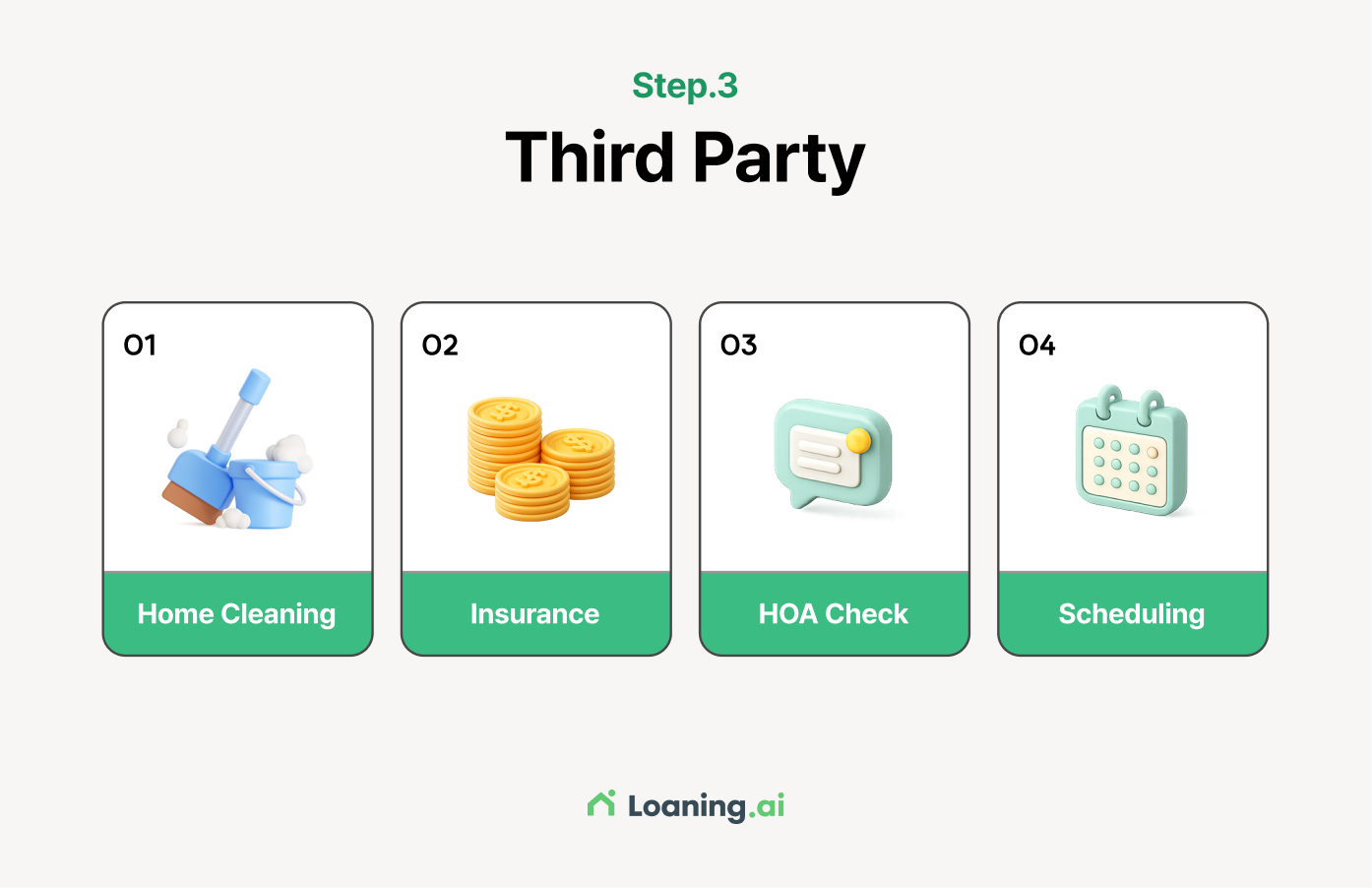

1. What Exactly Do Third-Parties Do?

Simply put, the Third-Party stage is when the lender collects information about the home itself.

In Ep. 2, the lender collected information about you (the borrower). In this step, the lender verifies the safety, value, and legal status of the home.

Here’s how the three main participants in a mortgage are structured:

✓ 2st Party: The lender (Loaning.ai) issuing the loan

✓ 3rd Party: Independent external service providers verifying objective facts

✅ Common Third Parties

| Service Provider | What They Check |

|---|---|

| Appraiser | Is the home’s market value appropriate? |

| Title Company | Are ownership and rights clear of any issues? |

| HOA | Is the condo/townhome community financially sound and safe? |

| Insurance Company | Is the buyer properly insured for fire and disasters? |

2. Major Third-Party Tasks & Timelines

Third-Party professionals check the home’s value, legal standing, HOA health, and insurance readiness. Essentially, they determine whether the property qualifies as acceptable collateral for the loan.

✅ Third-Party Processing Timelines

| Item | Service Provider | Typical Duration | Notes |

|---|---|---|---|

| Appraisal Visit | Appraiser | 3–5 days | Scheduling the on-site inspection |

| Appraisal Report | Appraiser | 7–10 days | FHA/VA may follow regional SLA timelines |

| Preliminary Title | Title Company | 3–5 days | Checks for liens, ownership disputes |

| HOA Docs | HOA | 5–10 days | Highly variable by state and HOA |

| Insurance Binder | Insurance Company | Same day – 2 days | Required before Closing |

3. What to Do When the Appraisal Is Lower Than the Contract Price

Suppose you signed a contract for $1,000,000, but the appraisal comes in at $950,000.Your loan amount must now be based on $950,000, which may disrupt your financing plan.

Here are your three main options:

✓ Option B. Bring the Difference in Cash: You may need to increase your down payment to cover the gap.

✓ Option C. Cancel the Contract: If you have an Appraisal Contingency, you can walk away without penalty.

Yes. Basic tidiness is strongly recommended. Clutter that interferes with photos or access can negatively affect the appraisal.

4. Must-Do Action Steps During the Third-Party Stage

Loaning.ai handles communication with appraisers, title companies, and HOAs. However, Homeowner’s Insurance is entirely up to you and requires your active involvement.

Buyers must select their own Homeowner’s Insurance.

Get quotes from 2–3 companies, compare coverage and premiums, then send your Insurance Binder to the lender.

2. Stay Alert for HOA Requests:

For condos/townhomes, the HOA may request fees or questionnaires.

Check your email frequently and respond promptly to avoid delays.

3. Cooperate for the Appraisal Visit:

The appraiser must be given access to the property.

Confirm the date and time in advance with your realtor.

5. Hidden Risks: Title Issues & HOA Problems

Title issues can be as serious as appraisal problems. If the previous owner left liens or unresolved legal claims, your closing may be delayed until the issue is cleared.

For condos/townhomes, poor HOA financials or ongoing lawsuits can trigger loan denial. HOA documents often take 5–10 days to obtain, so we strongly recommend that you prepare for them in advance.

6. After All Third-Party Steps Are Done, Your Loan File Enters Underwriting

Step 3 is complete when the following four items are ready:

✅ Preliminary Title Report(Prelim)

✅ HOA Docs/HOA Certification (if applicable)

✅ Insurance Binder

These are combined with the income, asset, and credit documents collected in Ep. 2 and sent to the underwriter for the next stage: Step 4 – Underwriting & Conditions. There, the underwriter reviews everything and determines whether your loan will receive final approval.

If you want to know how your file is progressing through the Third-Party stage, reach out to your Loaning.ai representative. We’ll help you review the entire process to ensure a safe and smooth transaction.

📝 Quick Checklist

| Checklist | Details |

|---|---|

| Check Progress | Have you confirmed with your loan officer that the appraisal and title orders have been submitted? |

| Insurance Shopping (Required) | Have you obtained quotes for your Homeowner’s Insurance? |

| Agent Coordination | Have you shared the contact information of your selected insurance agent with Loaning.ai? |

![Things to Check When Your Closing Disclosure and LE Don’t Match [Mortgage Guider Ep. 6]](https://blog.loaning.ai/en/wp-content/uploads/2026/01/6-350x250.jpg)

![Revised LE & Rate Lock: What to Do and When [Mortgage Guide Ep. 5]](https://blog.loaning.ai/en/wp-content/uploads/2026/01/5-350x250.jpg)

![The Hidden Truth Behind U.S. Mortgage Underwriting: Why Do Approvals Get Delayed? [Mortgage Guide Ep. 4]](https://blog.loaning.ai/en/wp-content/uploads/2026/01/4-350x250.jpg)