Have you checked the Torrance conforming loan limits yet?

As home prices continue to rise, keeping track of annual loan limit updates—especially the Torrance conforming loan 2026 figures—is a key factor in making successful real-estate investments.

In this guide, we take a closer look at the 2026 loan limits by unit count in Torrance, California, along with a breakdown of the differences between Conforming Loans and Jumbo Loans 😎

..

..

2026 Torrance Conforming Loan Limits

Torrance includes high-value residential neighborhoods such as Hollywood Riviera and West Torrance, along with top-rated school districts. As a result, it is classified by the Federal Housing Finance Agency (FHFA) as a High-Cost Area.

Accordingly, the 2026 conforming loan limits for Torrance (Los Angeles County) are set significantly higher than in standard regions.

If the loan amount is within the limit:

You may qualify for a Conforming Loan, which typically offers lower interest rates and more flexible underwriting.

If the loan amount exceeds the limit:

It will be classified as a Jumbo Loan, which requires higher credit scores and stronger asset documentation.

.

.

How the Torrance Conforming Loan 2026 Limit Applies: Practical Scenarios ✨

Let’s look at how these limits work in real-world purchasing situations in Torrance (assuming the 1-unit limit of $1,249,125).

Based on Torrance’s conforming loan limit of $1,249,125, it is essential to accurately determine whether your financing strategy falls under a standard conforming loan or a jumbo loan.

If your loan amount exceeds this threshold and jumbo financing becomes necessary, stricter credit requirements and asset documentation will apply—so consulting with a mortgage professional early and preparing thoroughly is strongly recommended.

.

.

Conforming Loan vs. Jumbo Loan

Below is a side-by-side comparison of the strengths and requirements of the two major financing options when purchasing a home in the Torrance area.

| Category | Conforming Loan (Standard Loan) | Jumbo Loan |

|---|---|---|

| Pros | • Generally lower interest rates • More flexible underwriting standards • Lower down payment options available | • Enables purchase of high-priced homes • Access to luxury residential markets • Competitive interest rate programs available |

| Cons | • Loan limits restrict purchase of expensive homes (Difficult to purchase high-priced homes) | • Generally higher interest rates • Much stricter underwriting standards (high credit scores, extensive asset verification required) • Larger down payment requirements |

| Key Requirements | • Recommended credit score: 620+ • DTI (Debt-to-Income Ratio): preferably under 43-50% | • Recommended credit score: 700-720+ • DTI: typically under 43% • Proof of 6-12 months of mortgage payment reserves required |

.

.

Pre-Approval Checklist for Torrance Conforming Loans

To compete successfully in Torrance’s tight housing market, preparation is essential. If jumbo loan financing is likely, thorough preparation becomes even more critical.

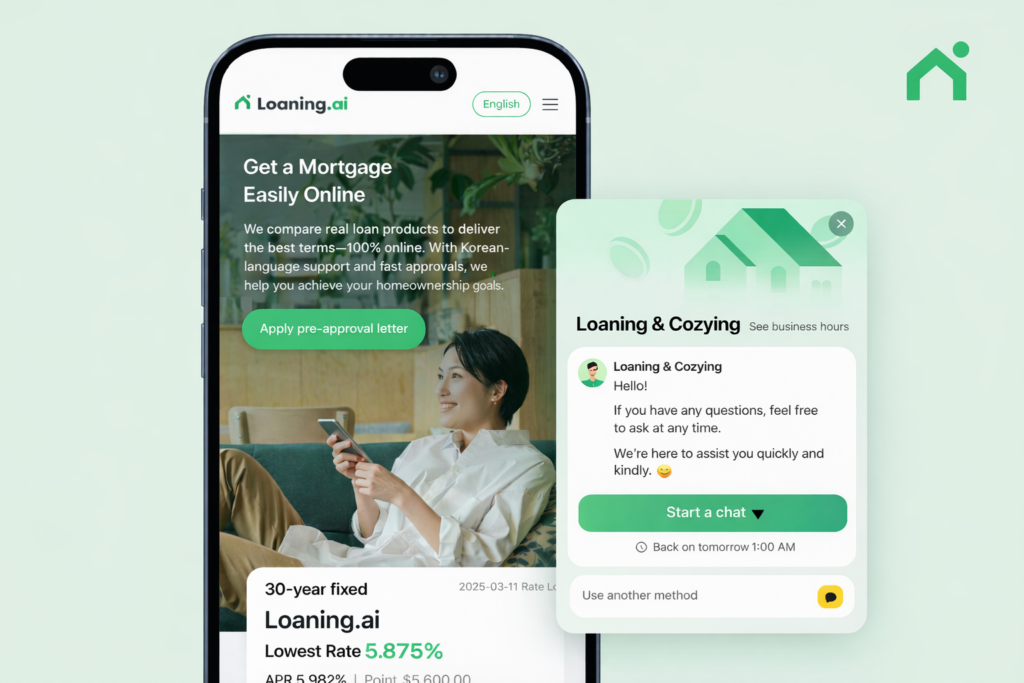

If you are deciding between conforming and jumbo financing, use the AI-powered mortgage solution Loaning.ai to compare optimal interest rates and loan terms.

Leave the complex calculations and comparisons to Loaning.ai. Loaning.ai provides mortgage solutions specialized for the Torrance market.

.