When you decide to buy a home in the U.S. and request a consultation with a lender, many buyers suddenly feel uncertain about what questions to ask when speaking with a loan officer.

Because the real-estate system and terminology are very different from those in Korea, even starting the conversation can feel intimidating.

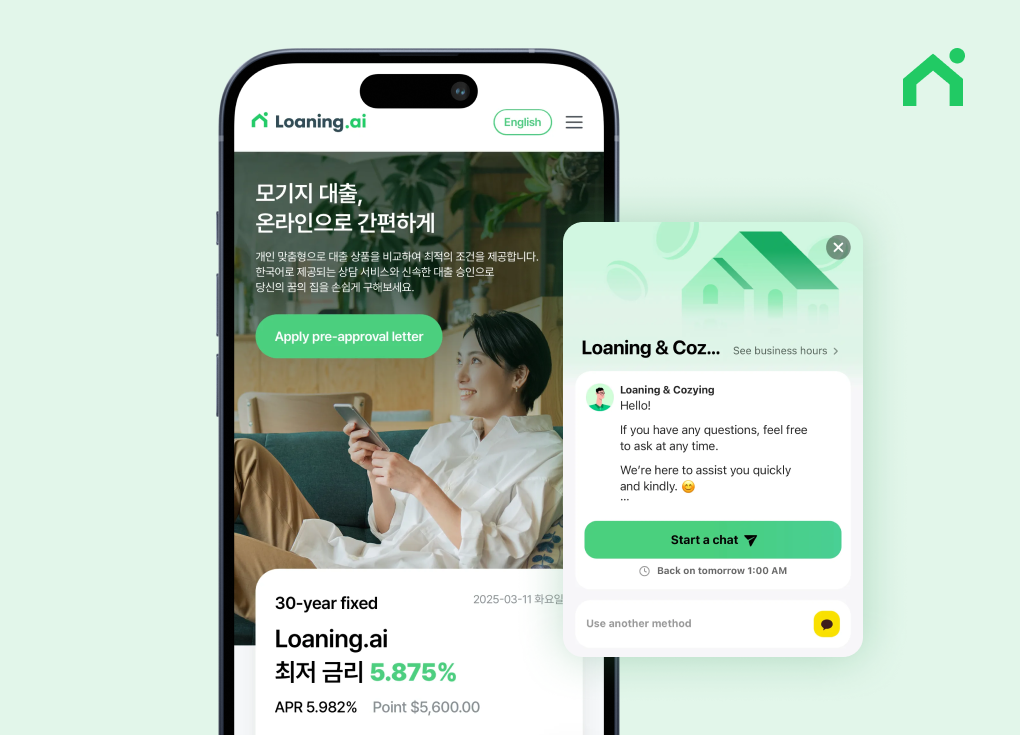

Loaning.ai has prepared a list of essential questions you should ask your real-estate agent or loan officer before purchasing a home in the U.S.

By asking the right questions, you can uncover better loan options and avoid unnecessary costs. 😌

.

.

Step 1. Finding the Right Program for You: Rates and Loan Options

The first things you should clarify are interest rates and loan programs. Instead of simply asking what today’s rate is, you need to confirm the details to determine which option best fits your situation.

Because U.S. mortgages come in many forms, eligibility varies depending on each borrower’s circumstances. While a 30-year fixed mortgage is the most common option, an adjustable-rate mortgage may be more suitable if you plan to stay for a shorter period or expect to relocate. If you are a Korean expatriate or still in the process of obtaining permanent residency, be sure to ask about programs designed for foreign nationals.

Many borrowers make decisions based only on the interest rate, but the more important figure to compare is the APR (Annual Percentage Rate). APR includes not only interest but also lender fees and other charges, providing a clearer picture of the loan’s true cost. If the rate looks low but the APR is unusually high, that loan may come with expensive upfront fees—so be sure to review it carefully.

Points are prepaid interest you pay at closing in exchange for a lower interest rate. If you plan to live in the home for five to ten years or longer, purchasing points to reduce monthly payments may be worthwhile. However, if you expect to move or refinance within a few years, minimizing upfront costs may be the smarter strategy. Ask your loan officer to provide quotes for both scenarios.

.

.

Step 2. Setting a Realistic Budget: Hidden Costs and Cash Preparation

Having a 20% down payment ready doesn’t mean your budgeting is complete.

U.S. real-estate transactions involve closing costs, so you must ask detailed questions about these expenses to avoid surprises.

.

.

Step 3. The Homebuying Journey: Process and Timeline

Buying a home in the U.S. typically takes longer and involves more steps than in Korea.

Understanding the full process and key deadlines in advance will help you avoid missing critical milestones.

A pre-approval letter is essential before submitting an offer. Without it, you may not even be able to tour certain homes. While this usually takes a few days, fintech lenders like Loaning.ai can issue approvals much faster once documents are ready. It’s best to secure pre-approval before you start house hunting.

In the U.S., the period from contract to move-in generally ranges from 30 to 45 days. However, if underwriting is delayed, you could miss deadlines—risking contract termination or penalties. Ask about the lender’s average processing time and confirm whether they can meet your desired move-in date.

From application and appraisal to underwriting, conditional approval, and closing, buyers have responsibilities at each stage. One especially important moment is the rate lock. Depending on market trends, ask whether you should lock your rate immediately or wait—professional guidance is crucial here.

.

.

Step 4. Evaluating Your Experts: Communication and Trust

Finally, make sure your lending partner is reliable and responsive.

The housing market is most active on weekends. If you attend an open house and need to submit an offer quickly, it can be a major problem if you cannot reach your loan officer. With Loaning.ai, you can communicate 24/7, 365 days a year.

Income documentation and visa requirements for Korean buyers can be challenging for many U.S. lenders to understand. It’s important to work with a lender—like Loaning.ai—who understands Korean-specific circumstances and can clearly explain them to underwriting teams.

./

.

Still worried about how to ask these questions in English or how to understand U.S. real-estate terminology?

If it all feels overwhelming, reach out to Loaning.ai. 🚪

As an officially licensed U.S. lender, Loaning.ai understands Korean buyers and helps navigate the complexity of the American system.

With 100% Korean-language consultations, personalized explanations, and transparent processes, we’re here to support your homeownership journey.

Click the chat button below to get started today. 😉