✓ Understand cash-out refinance, simply

✓ Three moments when you may need a large lump sum

✓ Typical costs and tips to reduce fees

If you’ve owned your home in the U.S. for several years, chances are your home value has increased since purchase. While rising property value is great news, many homeowners still think, “It’s not real money unless I sell.”

But is that really true?

There is a way to access your home’s increased value without selling your home—and that solution is cash-out refinance.

In this article, Loaning.ai explains how cash-out refinance works, how it helps unlock your home equity, and what costs to expect—clearly and transparently.

.

Cash-Out Refinance Is Like Calling a Bigger Vehicle

Imagine your current mortgage as a car driving you toward your destination. It works fine—until you suddenly need to carry much heavier luggage (a large amount of cash).

One option is to abandon the car entirely. But selling the car also means giving up your home.

If you want to keep your home while solving a cash-flow need, you’ll need a smarter transportation strategy.

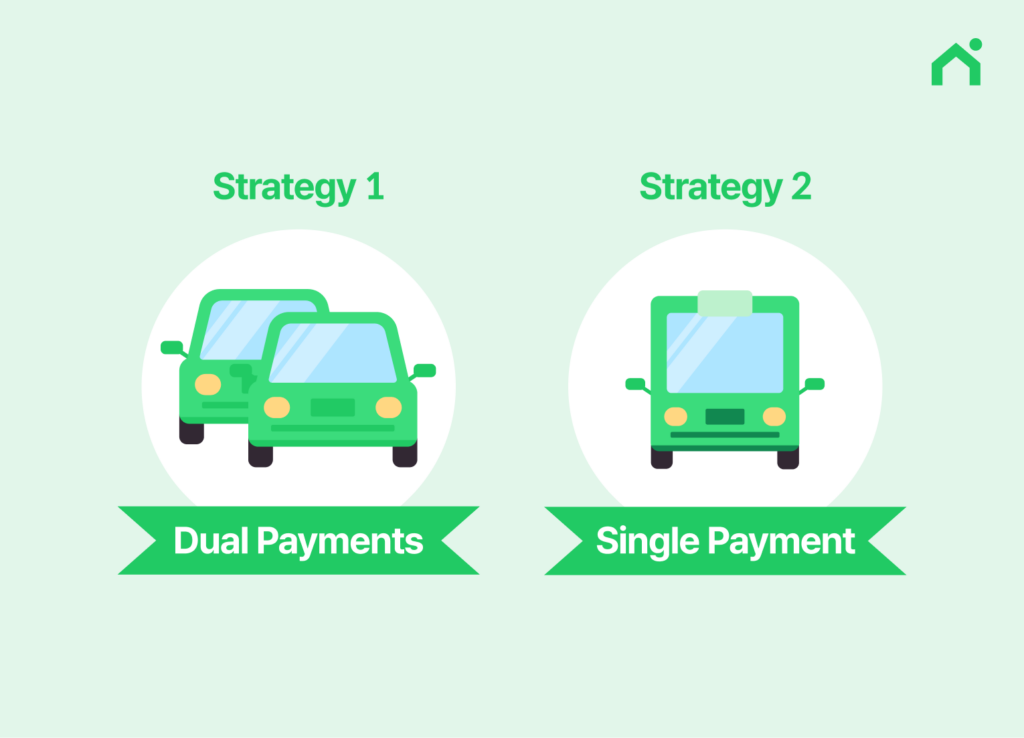

At this point, you have two options:

You keep your existing mortgage and take out a separate loan—such as a personal loan or second mortgage.

However, managing multiple loans is often less efficient and usually more expensive.

You replace your current mortgage with a larger one—this is cash-out refinance.

While the total loan balance may increase, it is often far more cost-effective than managing multiple high-interest loans. Everything is consolidated into one mortgage, at a lower overall rate.

.

When Is Cash-Out Refinance Useful?

Here are three common situations where cash-out refinance can be especially helpful:

① Home Maintenance & Renovation

Using your equity to improve your home—such as remodeling a kitchen or adding living space—is not just an expense. It’s often an investment that increases your home’s future value.

② Consolidating High-Interest Debt

If you’re carrying credit card balances or auto loans with interest rates near 20%, refinancing can significantly reduce your monthly interest burden by replacing high-interest debt with a lower mortgage rate.

③ Education or Business Needs

College tuition, unexpected business expenses, or emergency funding—your home can function as a reliable financial resource. Compared to unsecured loans, cash-out refinance often offers higher approval odds and larger loan amounts.

.

How Much Does Cash-Out Refinance Cost?

You may wonder, “Isn’t it expensive to pull cash out?”

Typically, closing costs range from 2–5% of the loan amount, but with the right strategy, these costs can be managed. Loaning.ai discloses all fees 100% transparently, based on legal classifications.

| Category | Current Loan(Before) | Option 1 |

Best Balance

Option 2(Recommended)

|

Option 3 | Option 4(No Out-of-Pocket) | Option 5(Cash Back) |

|---|---|---|---|---|---|---|

| Interest Rate(Rate) | 7.125% | 5.500% | 5.625% | 5.750% | 5.875% | 5.990% |

| APR | 7.125% | 5.547% | 5.634% | 5.762% | 5.840% | 5.918% |

| Monthly Payment(P&I) | $4,716 | $3,975 | $4,030 | $4,085 | $4,141 | $4,192 |

| Monthly Savings | – | $741 | $686 | $631 | $575 | $524 |

| Net Cost | – | $3,808 | $708 | $1,008 | -$2,692(receive cash) | -$5,692(receive cash) |

| Break-Even Period(BEP) | – | 5.1 months | 1.0 month | 1.6 months | Immediate savings | Immediate savings |

| Total Savings(30년) | – | $266,760 | $246,960 | $227,160 | $207,000 | $188,640 |

: These are pure administrative fees charged by the lender to process your loan.

✓ Underwriting Fee: The cost of thoroughly reviewing your income, assets, and credit.

✓ Processing Fee: The cost of preparing, collecting, and reviewing all required documents.

: Mandatory fees paid to external professional service providers, not the lender.

✓ Appraisal Fee: Paid to a licensed appraiser to determine the property’s market value. (Typically $600–$1,000)

✓ Credit Report Fee: Charged by credit bureaus for accessing your credit report.

: Required fees to verify and protect property ownership.

✓ Title Insurance: Insurance that protects against ownership disputes. (Typically $600–$1,000)

✓ Escrow / Settlement Fee: Covers secure handling and transfer of funds during closing.

: Mandatory fees paid to the state or county.

✓ Recording Fees: Fees for officially recording the new loan with the local government.

Use lender credits. By accepting a slightly higher interest rate, you can receive credits from the lender to fully offset the closing costs listed above. This is one of the smartest ways to secure liquidity without paying any cash upfront.