✓ Investment Property Refinancing Made Easy

✓ 3 Key Moments You Need a Lump Sum

✓ Tips for Reducing Costs and Fees

If you’re managing rental property in the US, there’s something just as important as the monthly rent coming in. That’s the increase in your home’s value – your equity.

Has your property increased in value since you bought it, yet you’re leaving that appreciation tied up in the house? If so, you’re neglecting one of your most powerful investment tools.

Today, we comprehensively outline the core strategies professional property investors use to double or triple their assets through refinancing, along with the specific precautions that differ from standard home ownership.

.

US Investment Property Refinancing : When Should You Do It

The goal is not merely to secure a lower interest rate. For investors, refinancing should be an active investment strategy to expand your portfolio and rebalance your returns. Here are the three most common optimal times.

The most aggressive and popular strategy is cash-out refinancing.

This method involves withdrawing equity gained from home value appreciation as cash and using it for the down payment on your next investment property. Without spending additional personal funds,

you can purchase a second or third property using only the appreciation of your existing asset, allowing you to enjoy the compounding effect of your wealth.

If you purchased when rates were high or are concerned about Adjustable Rate Mortgage (ARM) risks, you can switch to a lower fixed rate to reduce your monthly payments.

Lowering your monthly mortgage expense immediately increases your net rental income, which directly leads to a higher Return on Investment (ROI).

.

U.S. Investment Property Refinancing : Costs, Conditions

① Understanding the Difference in Interest Rates and LTV Limits

Generally, refinance rates for investment properties are set approximately 0.5% to 0.75% higher than those for primary residences. The loan-to-value (LTV) ratio is also slightly more conservative. Typically, a standard refinance allows for 75% to 80% LTV, while a cash-out refinance allows for 70% to 75%. This means you should ideally have at least 25% equity in your home to proceed smoothly.

② Proof of Reserves and Closing Costs

To verify your ability to cover mortgage payments, you may be required to provide proof of reserves equivalent to six months’ worth of payments. Additionally, closing costs such as appraisal fees and title insurance premiums will apply. Therefore, it’s advisable to consider a No Out-of-Pocket strategy, utilizing lender credits to reduce upfront expenses.

Let’s clarify the differences using the comparison table below.

| Type | Primary Residence | Investment Property |

|---|---|---|

| Interest Rate | Standard Rate | 0.5% ~ 0.875% Add-on |

| LTV Limit | Max 80~95% | Max 70~75% (Cash-Out) |

| Qualification | Personal Income (DTI) | Rental Income (DSCR) or Personal Income |

| Reserves | Approx. 2 Months | 6 Months of Payments |

.

If proving income is difficult, consider a DSCR loan

Are you residing in Korea or struggling with low reported income in the U.S.? In such cases, passing a standard mortgage review is challenging. This is where the DSCR (Debt Service Coverage Ratio) program, a tailored solution for investors, comes into play.

DSCR loans focus not on the applicant’s personal income, but on whether the rental income from the property can cover the mortgage payments. If the rental income is greater than or equal to the loan repayment amount (a ratio of 1.0 or higher), approval for refinancing an investment property is possible without complex income documentation.

.

Checklist for Successful Investment (ROI Analysis)

Conditional refinancing is not the right answer. Before proceeding, you must calculate the ‘break-even point’.

Refinancing involves closing costs (2–5% of the loan amount), such as appraisal and title fees. Calculate whether you can recoup these costs through your monthly savings within 30 months (2.5 years).

✓ Prepayment Penalty

Have you checked your existing mortgage for penalty clauses? Some commercial loans and investment products may charge a fee if the loan is paid off within 3 years.

✓ Seasoning Period

Has it been over 6 months since your purchase? Most lenders require at least 6 months of ownership before allowing a cash-out refinance. (However, “Delayed Financing” for cash purchases is an exception.)

.

Frequently Asked Questions

As mentioned earlier, essential costs such as appraisal and recording fees do apply.

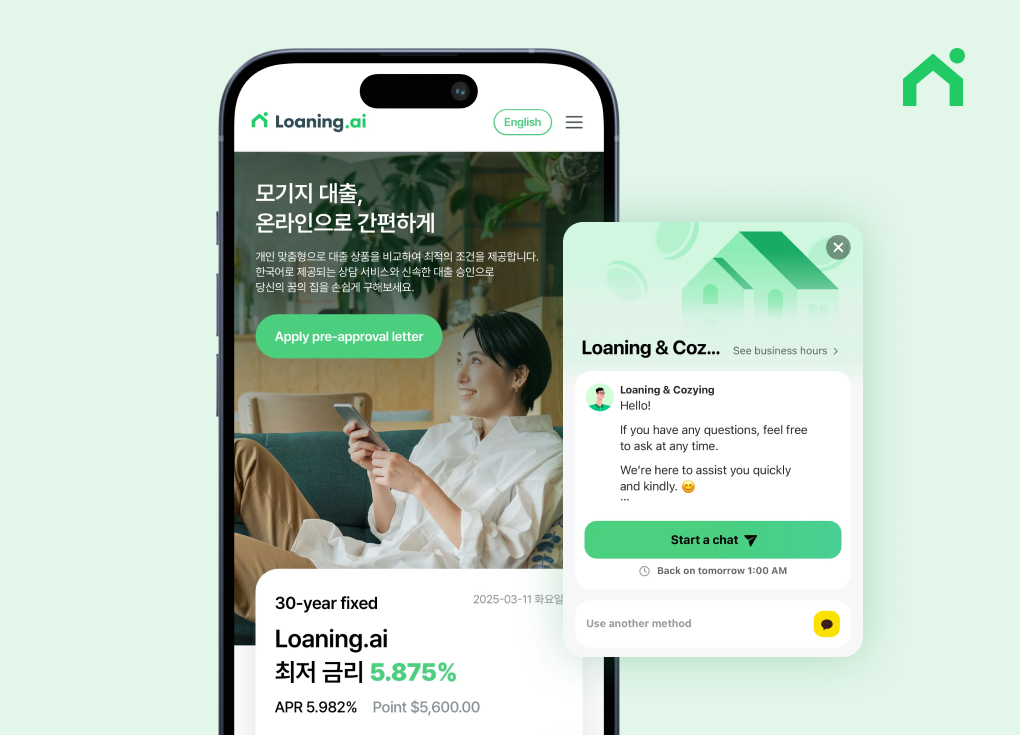

However, you can minimize this burden by leveraging Loaning.ai’s Lender Credit policy. In fact, many of our clients secure liquidity using our “No Out-of-Pocket” option, which requires no upfront cash.

There are no restrictions on how you use the cash-out funds. You are free to use them for home improvements, tuition, business investments, or any other purpose.

Additionally, since these funds are classified as debt rather than income, they are generally not subject to income tax. This is a significant tax advantage.

(Note: We recommend consulting with a tax professional for specific tax advice.)

Adapt flexibly to changing lifestyles.

Our lifestyles are constantly changing, and life often brings unexpected events without warning.

Loaning.ai provides tailored services that best fit our customers’ situations during these moments of change.

If you’re wondering, “How much cash can I get for my home right now?” feel free to contact us anytime.