✓ Waiting Periods After Bankruptcy

✓ Leveraging Non-QM Loans

✓ 3 Essentials to Boost Approval Odds

Life can sometimes lead to unexpected financial hardships, forcing you to consider bankruptcy. While bankruptcy is a difficult decision, it is also a legal system that breaks the cycle of unmanageable debt and offers a chance to start over. However, for those who own a home or plan to take out a mortgage again, a persistent worry lingers.

“With this record on my credit, will I ever be able to knock on a bank’s door again?”

To get straight to the point: yes, it is possible.

The key lies in precise timing and strategy. Today, we’ll detail exactly when refinancing becomes feasible after bankruptcy—a process that may seem daunting—and how to maximize your chances of approval.

.

Bankruptcy Refinancing: Waiting Period

If you wish to refinance after bankruptcy, you must carefully observe the ‘seasoning period’. The seasoning period refers to the time required for a loan applicant to demonstrate financial stability after bankruptcy. This period varies depending on the type of bankruptcy filed.

This is the most common type, where qualifying debts are fully discharged.

The waiting period is calculated starting from the discharge date ordered by the court.

This involves repaying debts over a fixed period (3–5 years). Since you are faithfully following a court-ordered repayment plan, the waiting period is shorter.

✓ Conventional Loan: 2 years after discharge or 4 years after dismissal

✓ FHA / VA Loans: Refinancing is possible even before discharge with 12 months of on-time payments and court approval

| Loan Type | Chapter 7 (Liquidation) | Chapter 13 (Reorganization) |

|---|---|---|

| Conventional Loan | 4 Years after discharge | 2 Years after discharge |

| FHA Loan | 2 Years after discharge | Eligible after 12 months of payments |

| VA Loan | 2 Years after discharge | Eligible after 12 months of payments |

| Non-QM | No waiting period | No waiting period |

.

Non-QM Bankruptcy Refinancing

“I need to settle my high-interest debt immediately—how can I wait two or four years?”

That’s precisely why Non-QM (Non-Qualified Mortgage) products exist.

These mortgages are offered by lenders who operate under their own criteria, not the strict guidelines of government agencies.

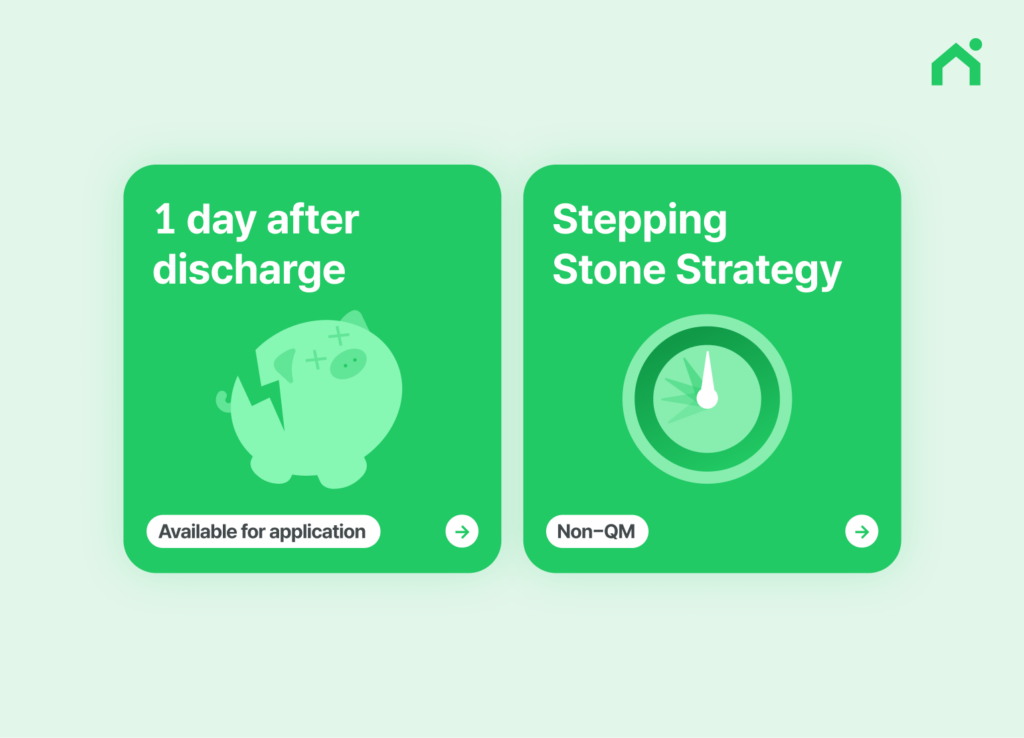

① Eligible to apply immediately after bankruptcy discharge

Some Non-QM programs allow applications as early as one day after discharge. Naturally, due to the associated risk, interest rates are typically higher than conventional mortgages, and they may require more equity (LTV ratio around 70-80%). However, if you need to put out the fire and save your home, this becomes the most realistic alternative.

② Utilizing a Bridge Strategy

First, secure liquidity by refinancing after bankruptcy using a Non-QM loan.

Diligently make payments to rebuild your credit score.

After the seasoning period, switch to a conventional loan with a lower interest rate.

3 Essential Preparations to Boost Approval Chances

Conditional refinancing isn’t the right answer. Before proceeding, you must calculate the ‘break-even point’.

Avoiding credit cards entirely after bankruptcy is not recommended. You should open a “Secured Credit Card” (backed by a deposit) and consistently pay off small balances to recover your score quickly. It is recommended to maintain at least 2–3 active accounts.

This is the most critical factor. You must not have a single late payment on any bills after bankruptcy, including utilities, rent, and auto loans. A late payment after filing is a fatal red flag to lenders and destroys the trust you have worked to rebuild.

You need to prepare a letter explaining the circumstances that led to your bankruptcy. If there were extenuating circumstances such as medical expenses, job loss, or divorce, clearly state them and demonstrate how your financial situation has since improved. A well-written letter can favorably influence the underwriter’s decision.

.

Frequently Asked Questions

As mentioned earlier, essential costs such as appraisal and recording fees do apply.

However, you can minimize this burden by leveraging Loaning.ai’s Lender Credit policy. In fact, many of our clients secure liquidity using our “No Out-of-Pocket” option, which requires no upfront cash.

There are no restrictions on how you use the cash-out funds. You are free to use them for home improvements, tuition, business investments, or any other purpose.

Additionally, since these funds are classified as debt rather than income, they are generally not subject to income tax. This is a significant tax advantage.

(Note: We recommend consulting with a tax professional for specific tax advice.)

Adapt flexibly to changing lifestyles.

Our lifestyles are constantly changing, and life often brings unexpected events without warning.

Loaning.ai provides tailored services that best fit our customers’ situations during these moments of change.

If you’re wondering, “How much cash can I get for my home right now?” feel free to contact us anytime.