As we approach the end of 2025, the California real estate market is focused on one major update: the 2026 Conforming Loan LA limit.

Los Angeles and Orange County—two of the most popular areas among Korean homebuyers—remain some of the strongest and most resilient housing markets due to excellent schools and high quality of life.

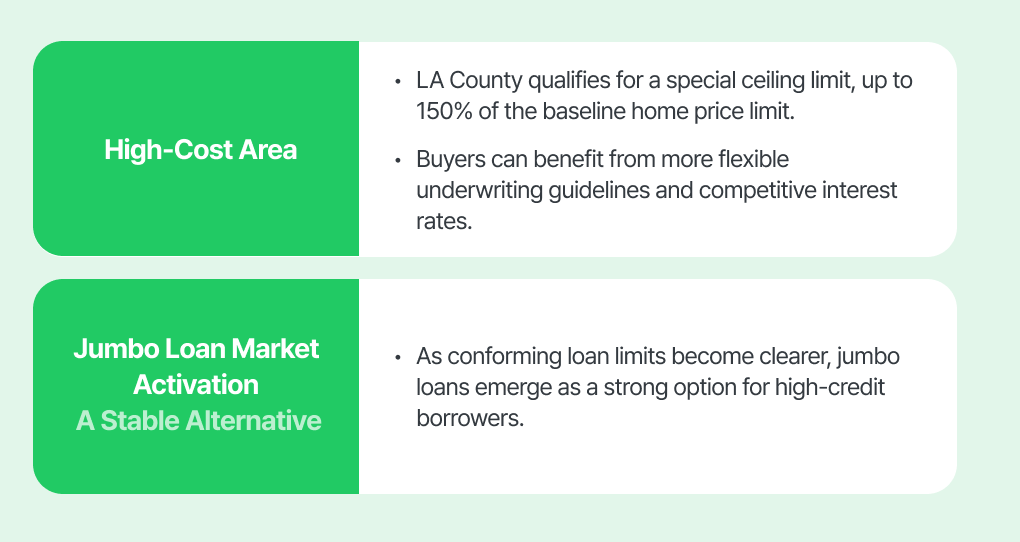

Because LA is classified as a federal High-Cost Area, it qualifies for significantly higher loan limits than standard counties.

Today, we’ll break down the confirmed 2026 Conforming Loan LA limits and explain how you can build the most effective homeb

.

.

How Much Did the 2026 LA Loan Limits Increase?

An increase in loan limits means increased purchasing power.

Instead of the national baseline, LA County receives a high-cost ceiling limit, which is approximately 150% of the standard conforming loan baseline.

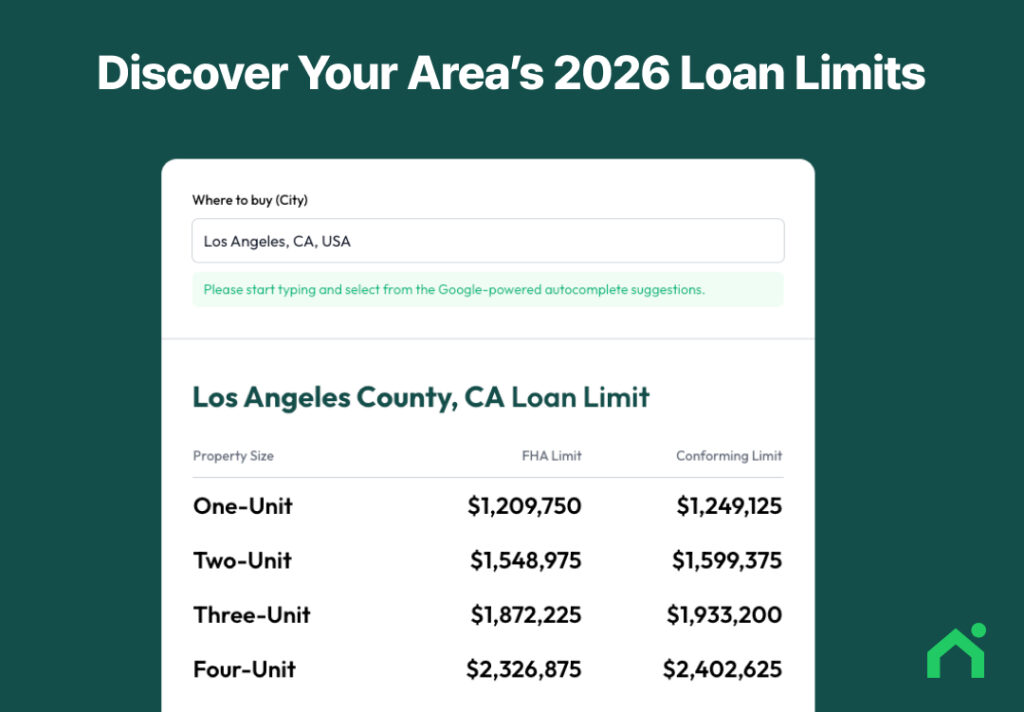

Here are the confirmed 2026 loan limits by property type in LA County:

This means loans up to approximately $1.25 million can now qualify for conforming guidelines—often offering lower interest rates and less stringent underwriting compared to jumbo loans. For buyers considering homes above $1 million, this is a major advantage in both rate savings and approval flexibility.

.

.

Mortgage Strategy for 2026 Conforming Loan LA

With the updated 2026 limits, which strategy should you choose?

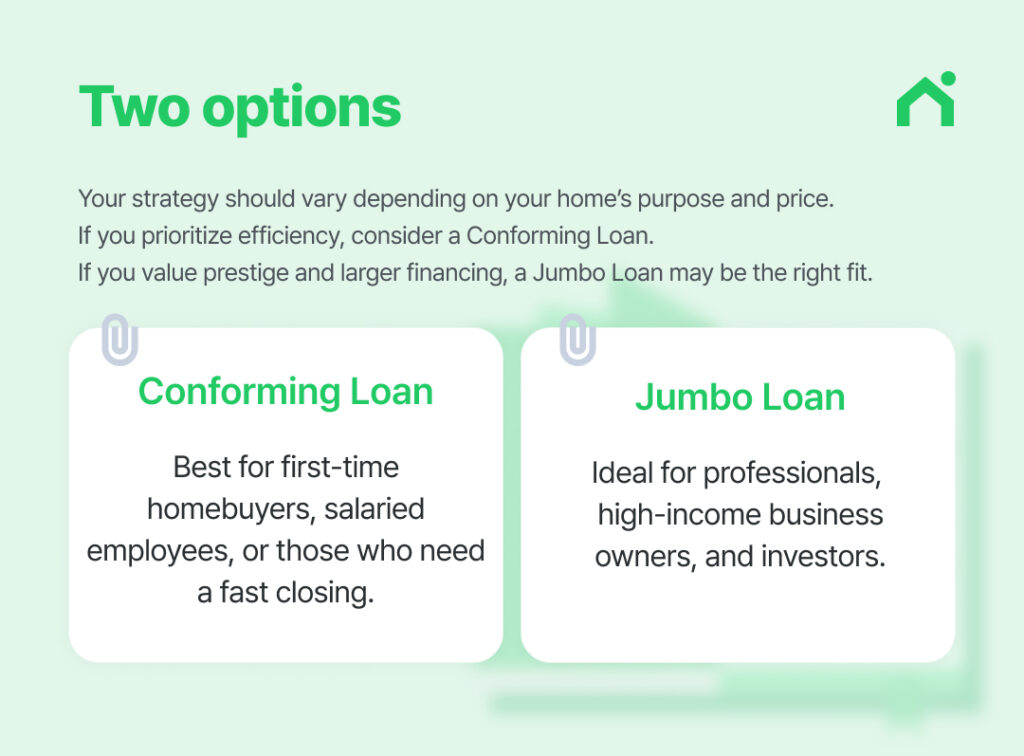

Depending on your financial profile and purchase goals, both conforming and jumbo loans can be powerful tools.

| Category | Conditions & Recommended For | Key Benefits |

|---|---|---|

|

Option A

Maximize Efficiency (Conforming Loan) |

Conditions Home price up to $1,249,125 Recommended For First-time homebuyers, salaried employees, and those who need a fast closing. |

|

|

Option B

Value & Quality (Jumbo Loan) |

Conditions Purchasing homes in prime areas such as Beverly Hills. Recommended For Professionals, high net-income business owners, and investors. |

|

.

.

2026 Checklist for Korean Buyers in LA

To fully leverage the 2026 Conforming Loan LA limit, preparation is critical. Here are three key qualifications buyers often overlook:

.

.

Make 2026 the Year You Own in LA

Your dream home in Los Angeles may be closer than you think.

Don’t navigate California’s complex mortgage market alone. Loaning.ai will help you maximize the updated 2026 Conforming Loan LA limits and secure the most competitive rate available for your situation.