Irvine, California is often described as one of the most desirable master-planned cities in the U.S. Known for top-rated schools, safety, green spaces, and proximity to UC Irvine, it consistently attracts families and professionals seeking long-term value.

However, Irvine’s strong housing demand comes with a challenge: high home prices. Many buyers wonder whether traditional financing can realistically support Irvine’s competitive market.

The newly announced 2026 Conforming Loan Irvine limits bring important news. With higher conforming loan limits in Orange County, properties that previously required a Jumbo Loan may now qualify under a Conforming Loan—often offering more flexible guidelines and competitive rates.

Let’s break down what this means for your buying strategy.

.

.

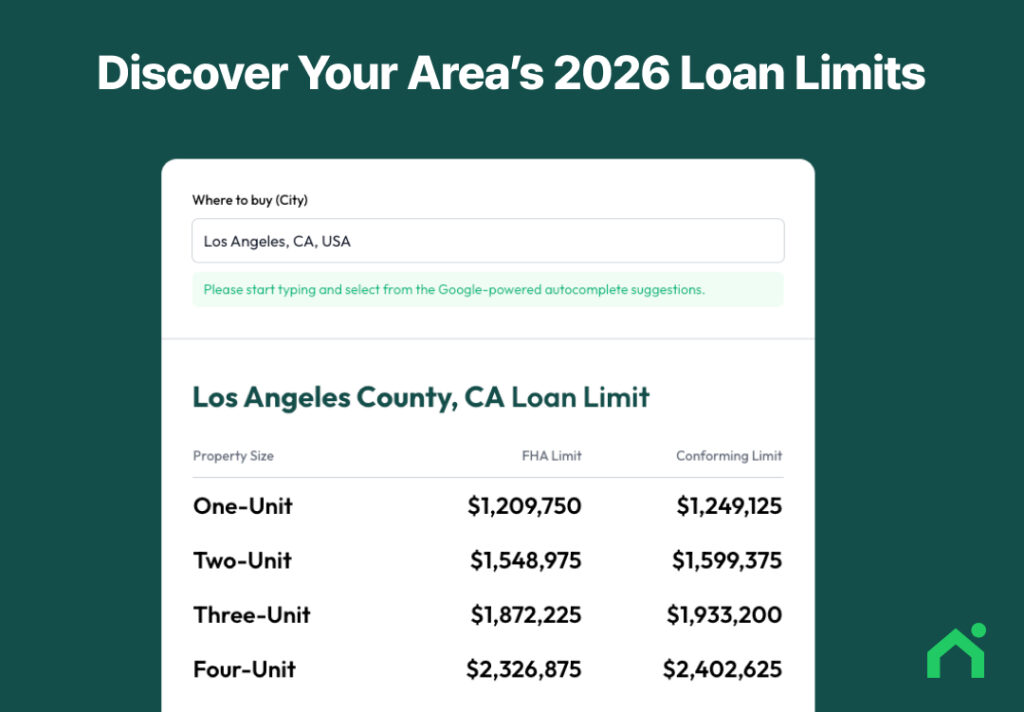

How Much Can You Borrow in Irvine?_2026 Conforming Loan Limit_Irvine

The 2026 loan limit in Orange County is approaching $1.25 million for a 1-unit property (single-family home or condo).

This is more than just a numerical increase—it signals a meaningful shift in purchasing options within the Irvine real estate market.

For 2026, Orange County’s confirmed loan limits are:

The most important number for Irvine buyers is the 1-unit conforming limit of $1,249,125.

Why is this significant?

With a 20% down payment, this allows buyers to purchase a home priced around $1.56 million without entering Jumbo Loan territory. That expands options in Irvine’s mid-to-upper price segments while maintaining access to conforming loan advantages.

.

.

2026 Conforming Loan Irvine: Neighborhood-Based Strategy

How does this apply to real Irvine communities? Let’s compare two popular areas.

In Woodbridge and Westpark, the recent increase in the loan limit has brought most listings in these neighborhoods within the conforming loan range. By adjusting the down payment slightly, buyers can access lower interest rates and secure homes in top-rated school districts with greater financial efficiency.

In Great Park and Orchard Hills, home prices still exceed the conforming limit. As a result, Strategy B (Jumbo Loan) becomes necessary. However, jumbo loan rates have recently become highly competitive. For borrowers with strong credit profiles, it is possible to receive an interest rate that is equal to—or even lower than—a conforming loan.

.

.

Option A vs Option B: Which Mortgage Strategy Fits?

내가 살 집의 위치와 예산이 정해졌다면, 이제 나에게 맞는 모기지를 쇼핑할 차례입니다. 앞서 말씀드린 전략 A와 B, 두 가지는 얼바인 구매자를 위한 두 가지 핵심 전략이라고 할 수 있어요.

Once you’ve settled on a location and budget, it’s time to shop for the right mortgage. Strategy A and Strategy B(outlined above)are the two essential financing approaches for Irvine homebuyers.

| Category | Conditions & Recommended For | Key Benefits |

|---|---|---|

|

Option A

Maximize Efficiency (Conforming Loan) |

Conditions Home price up to $1,249,125 Recommended For Buyers targeting Woodbridge or Westpark, salaried professionals needing fast approval |

|

|

Option B

Value & Quality (Jumbo Loan) |

Conditions Great Park, Orchard Hills, or higher-priced new construction Recommended For Professionals, high net-income business owners, and investors. |

|

.

.

Irvine Buyer Checklist (2026)

Irvine remains highly competitive. When the right home appears, your financing must already be strong.

.

.

2026 Conforming Loan Irvine: Final Takeaway

The increased loan limit for 2026 significantly improves purchasing power in Irvine. However, the market remains fast-moving and competitive. Instead of guessing what you can afford, the smarter move is securing a precise pre-approval based on your income, credit, and assets.

Don’t navigate the complex Orange County mortgage market alone.

Loaning.ai will analyze your financial profile and the specific characteristics of Irvine properties to find the most competitive options tailored to you.

.

.